South Korea’s three main casino operators had a mixed start to 2016, with one operator faring significantly better than the others.

South Korea’s three main casino operators had a mixed start to 2016, with one operator faring significantly better than the others.

Kangwon Land, the only one of the country’s 17 small-scale casinos that admits local residents, reported modest revenue gains in the three months ending March 31 but a tight grip on costs and a strong slots performance produced a more pronounced rise in Q1 profits.

Kangwon Land revenue rose 2.6% year-on-year to KRW 436.5b (US $373.2m) while earnings rose 5% to KRW 177.9b and net income jumped 7.9% to KRW 142.8b ($122m).

Daiwa Securities analysts said Kangwon Land’s management expected growth to pick up speed into H2 2016 thanks to more efficient allocation of gaming tables, an improving VIP market and an increase in the number of mass market visitors.

The latter factor will be driven in part by the late-2016 opening of a second highway connecting the adjacent city of Wongju with Gwangju, South Korea’s sixth largest metropolitan area.

GRAND KOREA LEISURE MISSES ITS CHINESE

Things were less rosy at Grand Korea Leisure (GKL), which operates three foreigners-only casinos under the Seven Luck brand. GKL said its Q1 revenue was down 8% to KRW 136.5b, and while earnings were better than forecast at KRW 42b, profit was down 16.5% to KRW 27b ($23m).

GKL has been struggling to adjust as its flow of high-rollers slowed last year due to a triple whammy of China’s souring economy, a hostile government in Beijing and South Korea’s highly publicized fatal outbreak of infectious disease.

GKL’s falling VIP turnover continued to drop in Q1 and the company was doubly cursed by a lower than usual VIP hold percentage. The numbers of Chinese VIPs fell 38% year-on-year, while ‘other’ countries VIP contributions were down 13%. Only Japanese VIPs were on the upswing, and only by 2%.

PARADISE CO LTD HAS SUCKY Q1, FOCUSES ON PARADISE CITY PROGRESS

The situation was even more dire at Paradise Co Ltd, the country’s largest foreigners-only casino operator. While sales at the company’s five casinos were up 3.7% to KRW 157b, profit fell 62% to KRW 14.6b. As bad as that sounds, it’s four times the profit Paradise booked in Q4 2015.

Paradise was tight-lipped regarding the downturn but Daiwa analysts blamed a poor performance at its Busan property and increased staff and marketing costs. Like GKL, Paradise dealt with its lack of Chinese VIP traffic by focusing on Japan, boosting that country’s share of Paradise’s VIP business by more than four points to 22.1%.

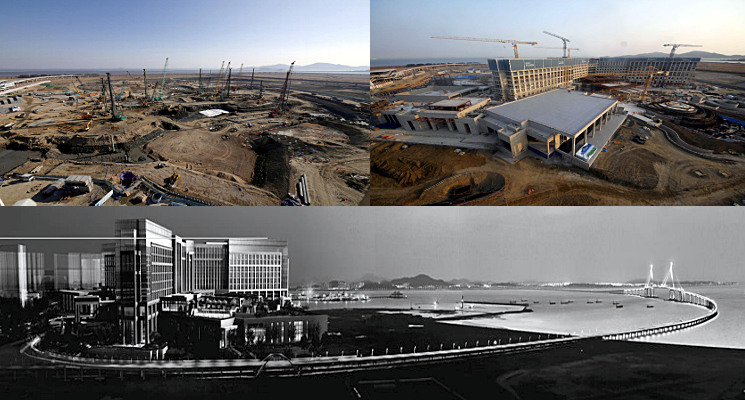

Paradise is currently constructing Paradise City, a joint venture with Japan’s Sega Sammy Holdings that will be South Korea’s first new integrated resort when it opens in April 2017.

Paradise recently posted some photos to demonstrate the project’s development progress, with the photo on the left showing the view in March 2015, while the photo on the right is the same camera angle from last month, and the bottom image is said to represent the finished product.