Greek lottery and betting giant Intralot continued to bleed red ink in the third quarter and is pinning its hope of a rebound on securing more US sports betting opportunities.

Greek lottery and betting giant Intralot continued to bleed red ink in the third quarter and is pinning its hope of a rebound on securing more US sports betting opportunities.

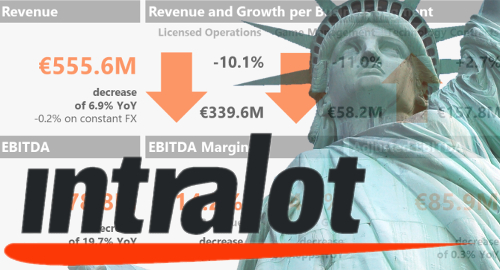

Intralot reported gross gaming revenue of €99.8m in the three months ending September 30, a 2.7% fall from the same period last year. Earnings fared worse, falling 29% to €20.1m. For the year-to-date, revenue is down 3.3% to €329m while earnings are off 19.7% to €78.8m.

Sports betting has become Intralot’s main vertical, accounting for 44.1% of its year-to-date revenue, slightly ahead of lottery games’ 42.9% share. IT Products & Services claimed a 6.1% share, video lottery terminals added 4.3% and racing brought up the rear with 2.6%.

Intralot’s year-to-date performance has suffered through turmoil in some of its major markets, including Bulgaria, where revenue dipped by €22m on lower sports betting performance. Argentina’s battle with hyperinflation pushed Intalot’s revenue down €18.4m in Euro terms, although the results were up 20% in local currency.

Intralot CEO Sokratis Kokkalis defended the company’s results, noting that the company is doing its best to offset the loss of some major contracts, including supplying technology to Turkey’s state-owned sports betting business. Kokkalis said the company was making progress on its ‘three-prong strategy’ of cost-reductions, signing new tech deals and selling off non-core assets.

On that last note, Kokkalis hailed his company’s recent sale of its stake in Italian gambling operator Gamenet to a subsidiary of hedge fund giant Apollo Global Management, which will add €78m to Intralot’s coffers and will help offset the company’s net debt (€634m as of September 30). Intralot also scored €20m through the completion of the sale of its stake in Hellenic Lotteries to fellow Greeks OPAP.

The third quarter saw Intralot’s US fortunes rise through the signing of sports betting contracts in the District of Columbia and New Hampshire. Both launches are expected in early 2020 although the launch of the DC mobile betting monopoly has been delayed following legal challenges of Intralot winning the controversial no-bid betting tender.