Online gambling operator The Stars Group (TSG) lost nearly $52m in the third quarter as costs grew faster than its revenue.

Online gambling operator The Stars Group (TSG) lost nearly $52m in the third quarter as costs grew faster than its revenue.

Figures released Thursday by the Canada-based, US-listed TSG show total revenue of US$622.5m in the three months ending September 30, a year-on-year rise of nearly 9%. But rising expenses brought operating income down 77% to $16.3m, and the company booked a net earnings loss of $51.7m versus a $9.7m profit in Q3 2018.

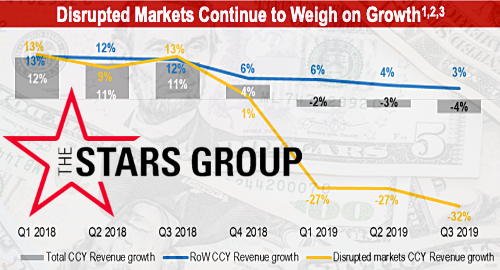

On a product basis, TSG’s flagship PokerStars brand reported poker revenue falling 10.7% to $192.6m, with the site’s exit from Switzerland and payment-blocking in grey/black ‘disrupted’ markets like Norway and Russia once again getting the blame.

Gaming revenue fared better, rising 7.5% to $194.6m, while betting posted the largest segment gain, up 37.7% to $218.2m, reflecting a full quarter of contributions from the UK-facing Sky Betting & Gaming (SBG), which TSG officially absorbed on July 10, 2018.

On a geographic basis, TSG’s International market segment – which relies heavily on poker – saw revenue fall 7.7% to $325.5m as poker dipped 10.8% to just under $190m. It could have been much worse, as net yield per international active user was up 1.6%, blunting the impact of a 9.5% decline in quarterly active users.

The SBG business in the UK reported revenue up nearly 35% to $227m as sports betting stakes rose 12.6% and betting margin improved by 2.4 points to 9.4%, pushing betting revenue up 52.6% to $130m. UK gaming revenue was up 16.2% to $85.2m.

In Australia, TSG’s BetEasy online betting brand reported revenue up 36.4% to $71.2m, as a 3.3-point margin rise offset a nearly 12% fall in betting stakes. Reduced expenses allowed the Aussie unit to report operating income of $1.24m from a nearly $26m loss in Q3 2018.

TSG said little about its new US-facing Fox Bet joint venture with FOX Sports, which launched real-money play in New Jersey and Pennsylvania during Q3 while its free-play Fox Sports Super 6 product has racked up 820k downloads as of October 27. Despite ‘encouraging’ customer activity, TSG sill projects Fox Bet to lose around $40m this year.

Because of its pending merger with UK gaming giant Flutter Entertainment, TSG execs held no earnings call with analysts this time around.