Regional casino operator Penn National Gaming (PNG) has announced four sports betting and online gambling deals with DraftKings, PointsBet, theScore and The Stars Group, as well as a new exclusive betting partnership with Kambi.

Regional casino operator Penn National Gaming (PNG) has announced four sports betting and online gambling deals with DraftKings, PointsBet, theScore and The Stars Group, as well as a new exclusive betting partnership with Kambi.

On Wednesday, PNG announced that it had struck four separate deals that will enable the company’s properties to offer online gambling and sports betting in states where such activities are legal. PNG’s online gambling subsidiary Penn Interactive Ventures (PIV) will manage these relationships.

The specifics of each deal are fairly involved, including which company gets to operate first, second or third online gambling/betting ‘skins’ in each market in which PNG has a presence. Two of the deals also involve PIV taking an equity stake, so we strongly encourage interested parties to read the whole enchilada here.

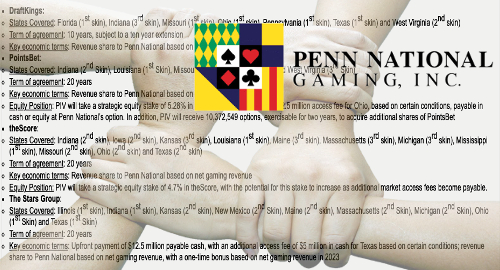

In alphabetical order, PNG has struck a 10-year revenue sharing deal with daily-fantasy-sports-turned-sports-betting operator DraftKings covering PNG’s casinos in Florida, Missouri, Ohio, Pennsylvania, Texas and West Virginia.

Next, Australian betting operator PointsBet has struck a 20-year revenue-sharing deal that covers casinos in Indiana, Louisiana, Missouri, Ohio and West Virginia. PIV will also take a 5.28% equity stake in PointsBet with options to acquire an additional 10.4m PointsBet shares, plus an additional $2.5m access fee for the Ohio operations.

Moving north, PIV is taking a 4.7% stake in Toronto-based digital media outfit theScore, with the potential for enlarging this stake “as additional market access fees become payable.” The partners will share online gambling/betting revenue from PNG properties in Indiana, Iowa, Kansas, Louisiana, Maine, Massachusetts, Michigan, Mississippi, Missouri, Ohio and Texas for the next two decades.

Sticking in Toronto, The Stars Group has signed a 20-year revenue-sharing deal covering Illinois, Indiana, Kansas, Maine, Massachusetts, Michigan, New Mexico, Ohio and Texas. The deal also gives PNG an upfront payment of $12.5m, plus another $5m based on “certain conditions” in the Texas market, along with a one-time bonus depending on how high overall revenue gets by 2023.

If all that wasn’t enough, PNG announced an exclusive multi-state online and land-based sports betting agreement with technology provider Kambi following a competitive selection process. Kambi will launch the first retail sportsbooks of this partnership in the current quarter – starting in Indiana and Iowa – with online to follow in 2020.

Jon Kaplowitz, PNG’s senior interactive VP, said Kambi’s managed-trading services would allow PNG to control its front-end product and provide “a lasting and differentiated online and retail product experience for our customers.”

The new Kambi pact spells doom for PNG’s relationship with William Hill, who launched PNG’s first sportsbook in West Virginia in August 2018. Hills went on to launch sportsbooks at PNG properties in Pennsylvania and Mississippi but apparently couldn’t beat Kambi’s offer. Kambi’s most-favored-nation status could also spell trouble for the ‘first skin’ deals PNG struck with the other four operators if certain states authorize only one online skin per licensee.

This spring, PNG credited its nascent sports betting offering with helping to drive visitation to its casinos, which allowed the company to post record table games growth in Q1 2019. On Wednesday, Kaplowitz called betting an “exciting growth opportunity” and said the new skin agreements “will help fund the cost of launching and maintaining our primary sports betting and iGaming operations.”