Nordic online gambling operator Kindred Group saw its profits plunge in the first quarter of 2020 as regulatory penalties, restructuring costs and writedowns took their toll.

Nordic online gambling operator Kindred Group saw its profits plunge in the first quarter of 2020 as regulatory penalties, restructuring costs and writedowns took their toll.

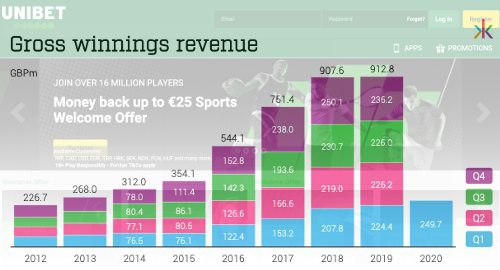

Figures released Friday by the Stockholm-listed Kindred show the company generated revenue of just under £250m in the three months ending March 31, 11.2% higher than the same period last year. But earnings rose a more modest 6.2% to £32.5m and after-tax profits tumbled to just £1m from £15.1m in Q1 2019.

The profit column suffered a nearly £21m hit from a variety of factors, including allocating funds for the company’s staff cull, a record fine in Sweden’s (over)regulated market and “accelerated amortization of acquired intangible assets.” Investors weren’t bothered, pushing Kindred’s stock price up nearly 11% by the close of Friday’s trading.

Despite the pandemic-forced elimination of most sports events by March – which may be why betting stakes fell nearly 15% year-on-year – Kindred’s sports betting revenue was up 15% to £122.5m. Credit the gains to a gaudy 16.6% margin on pre-game wagers, while the overall margin after free bets was up 2.8 points to 10.7%.

The Casino & Games segment rose 6% to £112.9m, and while Kindred said the vertical picked up as live sports died, its share of Kindred’s total Q1 revenue fell three points year-on-year to 45%.

Kindred’s poker unit remains a minor player but was the star performer in percentage terms, shooting up nearly one-third year-on-year to £7.5m.

On a geographic basis, Kindred saw gains across the board, with Western Europe up nearly 10% to £153m, Nordics rising 8.5% to £67.2m, Central, Eastern & Southern Europe jumping nearly one-fifth to £21.8m and the ‘Other’ segment soaring 62.5% to an admittedly small £7.8m.

The US market accounted for £2.6m of Other revenue, a 53% improvement from Q4 but US expansion costs resulted in a negative earnings impact of £4.2m, of which £3m was marketing. Kindred is currently operating in New Jersey and Pennsylvania and inked a two-state betting partnership with Caesars Entertainment in February.

Since the quarter ended, daily revenues are averaging £2.2m, around 10% below what might be expected were there not a deadly coronavirus stalking the globe. The biggest hit is coming in France, which doesn’t allow online casino products, but Kindred somewhat acidly noted that the country’s harsh tax rates make it a low-margin market to start with so whatever.

In other news, the company announced this week that Johan Wilsby would be coming on board as Kindred’s new CFO sometime this autumn. Wilsby, who currently toils with eye-tracking tech outfit Tobii, will replace Albin de Beauregard, who announced his intentions to leave last November.