Nordic online gambling operator Betsson AB hasn’t seen a major increase in its online casino revenue, contrary to the current narrative surrounding the COVID-19 pandemic.

Nordic online gambling operator Betsson AB hasn’t seen a major increase in its online casino revenue, contrary to the current narrative surrounding the COVID-19 pandemic.

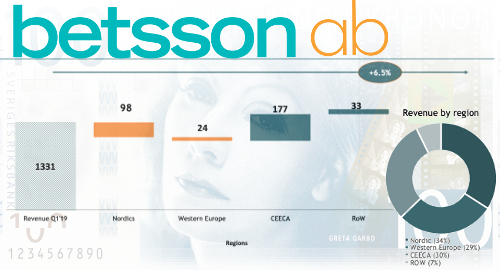

Figures released Thursday show Betsson generated revenue of SEK1.42b (US$141m) in the first three months of 2020, up 7% from the same period last year. Earnings rose 2% to SEK353m while net income was flat at SEK229.6m.

Sports betting revenue improved 29% to SEK385m, representing 27% of group revenue, up five points from Q1 2019. Betting turnover improved 8% while margins gained 2.2 points to 8.5%. The gains came despite the mass suspension of major sports events, leading CEO Pontus Lindwall to remark on how well the company has responded to the pandemic challenge.

Online casino revenue was flat at just over SEK1b, spoiling the prevailing narrative that frustrated sportsbook customers were migrating en masse to casino products. Betsson said it has noticed an uptick in online casino customers and activity in March and April, although active customers across all verticals suffered a modest decline in Q1.

Betsson’s core Nordic markets saw Q1 revenue fall 17% year-on-year as the company dealt with Sweden’s (over-)regulated market, which helped reduce Nordic share of overall revenue to 34%. Western European market revenue fell 6%, reducing its share to 29%.

By contrast, the primarily grey/black markets of the Central & Eastern Europe and Central Asia (CEECA) segment reported revenue rising 71%, pushing its share to 30%, but the company offered no explanation for the sudden surge. The Rest of the World segment anted up the remaining 7% of Betsson’s overall pie.

Trading in the first 16 days of April has been flat compared to the same period last year and the company says it’s too early to make any assumptions of the long-term impact of COVID-19. However, Lindwall said bettors’ embrace of alternatives such as ping pong and eSports was “an interesting increase in breadth which could be long term positive.”

Betsson recently launched Jalla Casino, a new mobile brand based on the quick-withdrawal model that currently represents around one-fifth of Sweden’s online casino market. Betsson expects to get a further boost from the acquisition of Gaming Innovation Group’s B2C brands, which was completed this month.

Betsson’s B2B sportsbook strategy inked its first customer in iBet, a division of Malta-based Claymore Group (the parent company of Asian-facing brand LeTou), although the launch of this product has understandably been postponed “until the leagues and tournaments resume.”