Online gambling operator Kindred Group is hoping that wagering on this summer’s European Championship will restore its flagging earnings after posting disappointing 2019 results.

Online gambling operator Kindred Group is hoping that wagering on this summer’s European Championship will restore its flagging earnings after posting disappointing 2019 results.

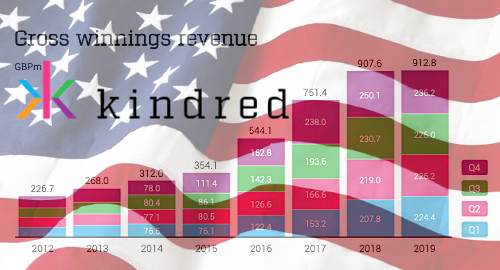

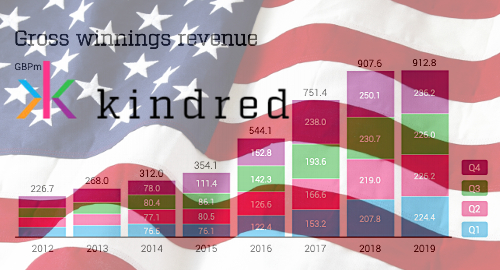

Figures released Wednesday by the Stockholm-listed Kindred show the company generated revenue of £236.2m in the final three months of 2019, down 6% from the final quarter of 2018. Earnings fell harder, down 49% to £30.7m, while pre-tax profits plunged 70.4% to just £13.3m.

Kindred had previously explained that Q4 suffered from “below average sports margins in many markets” and the much-publicized problems in the Netherlands and Sweden (the latter market alone resulted in a £6.6m earnings reduction). Kindred’s flagship Unibet brand also had its first full quarter of operations in New Jersey and Pennsylvania which required extra marketing expenditure.

For 2019 as a whole, Kindred’s revenue rose less than 1% to £912.8m, while earnings were down 36% to £130m and pre-tax profits tumbled 55% to £67.1m. Having already been prepped for the damage, investors largely shrugged and nudged Kindred’s share price up 1.4% on Wednesday.

Total sports betting revenue in 2019 was flat at £435.5m, as gains in Western European markets were offset by Nordic market declines. A similar geographical phenomenon resulted in casino, poker and bingo revenue rising only 1% to £477.3m.

Western Europe remains Kindred’s dominant region with a 61% share of overall revenue, four points higher year-on-year. Nordic markets’ share fell six points to 28%, while the Central, Eastern and Southern Europe segment gained two points to 7%.

Kindred had 27.3m registered customers at the end of 2019, up from 24.9m at the end of 2018. Active customers during Q4 fell 2% year-on-year to 1.6m but this represented a 15.6% gain from Q3.

Kindred also offered investors a preview of its 2020 turnaround, saying trading to date through February 9 showed revenue up 5% year-on-year (10% in constant currency) while January’s US market revenue was up 90% from December 2019.

The company is predicting great things from its ongoing US market expansion, which got a boost on Tuesday via a market access deal with Caesars Entertainment for Indiana and Iowa. That said, Kindred expects its 2020 US market operations to continue bleeding red ink, with the expected negative contribution to be twice the £6m earnings hit Kindred suffered in Q4 2019.

Kindred is betting on this year’s “summer of sports” to help right the ship, with major wagering expected on the Euro 2020 football tournament, the Tokyo Summer Olympic Games and the Copa América tourney.

Kindred CEO Henrik Tjärnström boldly predicted that Euro 2020 will be the company’s biggest event ever, in part due to the company’s expanded customer base and the fact that most of the markets in which Kindred operates have qualified teams for the tournament.

Kindred is also bullish after France finally shifted from an online betting tax based on turnover to a more traditional revenue-based system.