The stock market can be a funny place sometimes. If you were familiar with the social gaming business, and/or followed our coverage of the industry on this site, you probably wouldn’t think too highly of Zynga (ZNGA) right now. You’d know that the company abandoned its real-money gambling plans this summer, despite the fact that its former CEO Mark Pincus had repeatedly mentioned RMG as a game-changer for his company. You might be aware that the company’s most recent earnings report was a disaster, that its user base is declining, and that is no longer the dominant social media player, losing its casino title to Caesars Entertainment (CZR) and seeing King.com’s Candy Crush dominate the download and monetization rankings.

The stock market can be a funny place sometimes. If you were familiar with the social gaming business, and/or followed our coverage of the industry on this site, you probably wouldn’t think too highly of Zynga (ZNGA) right now. You’d know that the company abandoned its real-money gambling plans this summer, despite the fact that its former CEO Mark Pincus had repeatedly mentioned RMG as a game-changer for his company. You might be aware that the company’s most recent earnings report was a disaster, that its user base is declining, and that is no longer the dominant social media player, losing its casino title to Caesars Entertainment (CZR) and seeing King.com’s Candy Crush dominate the download and monetization rankings.

You might be aware that Zynga is firing staffers and executives alike, that Pincus had stepped down this summer, and that the company’s key relationship with Facebook (FB) is in tatters. And, so, if a friend told you that they owned Zynga stock, you might smirk and say something like, “What are you, @#$!#$! stupid?”

And they would grin and say, “Maybe, but the drinks are on me.” Because Zynga shares, surprisingly, have performed rather well of late. ZNGA stock is up about 20 percent in the last eight weeks, after bottoming in the wake of its RMG withdrawal and weak second quarter. Shares are up nearly 40 percent from lows seen in late June, before Don Mattrick was hired to replace Pincus atop the company. They’ve risen more than 50 percent since the first of the year, and by 48 percent over the past twelve months.

There are a number of reasons for this. One is the simple fact that the broad market has risen for most of the year – and indeed, US stocks as a whole have seen a basically uninterrupted bull run for two years. (The broad market bottomed in October of 2011, amidst fears of a sovereign debt crisis in Europe and weak economic data in the U.S.) And in a bull market, seemingly damaged companies can see their shares take off, as the stocks of higher quality companies get more expensive and investors begin to look for “bargains.” Indeed, looking at over 3,000 US-listed stocks with a market capitalization over $300 million, the 100 best-performing shares of 2013 include some unsurprising momentum-trading names like electric car manufacturer Tesla (TSLA), Internet provider Yelp! (YELP), and streaming content kingpin Netflix (NFLX). But there are also companies seemingly left for dead, such as a number of solar stocks, and retailers such as Best Buy (BBY) and grocer Supervalu (SVU), boosted by investors whose appetite for risk has increased amidst optimism about the broader market and the broader economy.

The second point in Zynga’s factor is that its risk is mitigated by its large cash balance; as of June 30th, the company still held over $1.5 billion in cash and investments; even at Friday’s elevated close of $3.61 per share, that cash represents over half of Zynga’s total market value. That cash can help put a floor underneath the stock; should Zynga hit levels of $2.40-$2.60 per share, investors may – rightly – argue that the risk/reward profile of the stock is in their favor. If Zynga continues to struggle, it is still unlikely that it would ever trade below $1.80-$2, the rough value of its cash and other assets (including its headquarters building), meaning shares might only drop 25-40 percent. Yet, should the company execute a turnaround, or a long-hoped-for (but likely unrealistic) acquisition by Google (GOOG) or Mattrick’s former employer Microsoft (MSFT) take place, the upside is substantially higher.

And as bad as Zynga’s results have been of late, that cash balance has remained safe; the company actually generated a modest amount of cash in the first half of 2013, and generated nearly $100 million in free cash flow in 2012 when excluding the $233 million purchase of its headquarters.

The problem, however, is that stocks are not based on past performance, but on future performance, and Zynga’s metrics simply collapsed in the most recent quarter. The Q2 report was largely overshadowed by the company’s retreat from real-money gambling – save for an essentially immaterial partnership with bwin.Party Digital Entertainment (BPTY.L) in the United Kingdom – but the bigger news was the destruction of the company’s legacy social gaming base. According to a presentation issued by Zynga in conjunction with the report, daily active users (DAUs) fell almost by half year-over-year, from 72 million to 39 million. Monthly users saw declines almost as severe. Bookings – the “fundamental top-line metric we use to manage our business,” according to Zynga’s SEC filings – fell nearly 20 percent from the first quarter and nearly 40 percent year-over-year. The massive workforce reductions have lowered the company’s cost base, but with revenue falling so steeply, Zynga will almost certainly post significant losses in the second half of the year.

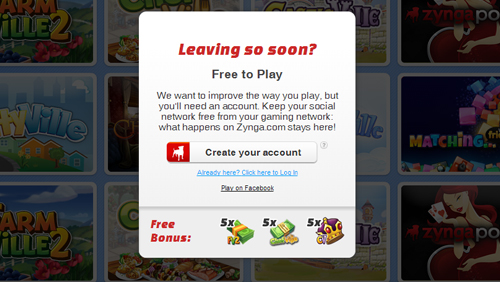

There has been much discussion about Zynga’s failure to compete and innovate. Its legacy hits such as Mafia Wars and Farmville grew stale; Mafia Wars was shut down while Farmville 2 is, according to the Q2 presentation, providing lackluster results. Zynga spent $200 million on studio OMGPOP and its hit Draw Something; Forbes would later note that Zynga appeared to buy the company on the exact day that Draw Something’s user base peaked, and OMGPOP was shuttered in August, little more than a year after its purchase.

But Zynga’s biggest failure appears to have been in mobile, a troublesome segment for companies all across the social sphere. Mobile fears were highlighted ahead of Facebook’s IPO, and likely contributed to that stock’s decline last year. And as I wrote last week, similar concerns have been raised ahead of the coming public offering of Twitter (TWTR) shares. But Facebook’s recent bull run – shares nearly tripled from 2012 lows before cooling off a bit of late – has been driven in large part by its ability to monetize mobile users. Given that Zynga is still reliant on that platform – 76 percent of Zynga revenue came through Facebook in the first half of the year – its mobile failures are all the more glaring. The company pointed out that 27 percent of bookings in the second quarter came from mobile, up from 19 percent in the year-prior period. But, as noted, bookings collapsed; using Zynga data, it appears that mobile bookings fell from $57.4 million in Q2 2012 to $50.8 million in Q2 2013. Meanwhile, King.com, buoyed by the mobile success of Candy Crush, is planning an IPO that could value the company at some $5 billion, according to reports.

It’s this comparison of Zynga to other social gaming companies that shows just how far the company has fallen behind. And it casts serious doubt on the stock’s recent run. Bear in mind that because of Zynga’s cash balance, the growth in its share price dramatically underrepresents just how much the valuation of Zynga’s business has increased. Back in November, I pointed out that Zynga’s enterprise value – its market capitalization less its cash and investments – was roughly $350 million, relative to trailing 12-month revenues of $1.27 billion. Its enterprise value is now some $1.3 billion, with twelve-month revenues down to $1.12 billion, and certain to fall below the billion-dollar mark no later than the end of this year. In other words, the market valuation of its business has nearly quadrupled in less than a year, over a period where the company has ceded dominance of nearly every key segment in the social gaming space, relinquished its admittedly unrealistic real-money gambling hopes, and seen a significant exodus of executives.

With third quarter earnings due next Thursday, Zynga shares seem likely to dip. With real-money hopes gone, the focus will be solely on the social gaming numbers, and it seems likely that they will post disastrous declines versus the prior-year period. Longer-term, new CEO Mattrick has his work cut out for him. What the company-wide declines, and the failure to adapt to mobile, show is that Zynga is not just one hit away. It is a company in need of a massive overhaul from top to bottom – one that Mattrick, to his credit, has already embarked on – and a sea change in its corporate culture. It needs to be an innovative, cutting-edge company that can compete not only with King.com and Facebook but with the incredible gaming experiences coming on the new consoles from Microsoft and Sony (SNE). Digital cows just won’t cut it anymore. Zynga needs to offer much, much more, but it’s still way to early tell whether they will ever be able to deliver.