The month of May was cruel to gambling stocks. After a strong four-month run to open 2012 – the Market Vectors Gaming ETF (BJK), comprised of over 50 gambling stocks worldwide, was up 22% year-to-date as of May 1st – the sector collapsed, giving back nearly all of the year’s gains in just five weeks, before a slight recent rebound along with a cautiously bullish broad market.

The month of May was cruel to gambling stocks. After a strong four-month run to open 2012 – the Market Vectors Gaming ETF (BJK), comprised of over 50 gambling stocks worldwide, was up 22% year-to-date as of May 1st – the sector collapsed, giving back nearly all of the year’s gains in just five weeks, before a slight recent rebound along with a cautiously bullish broad market.

With fears of a European collapse and a Chinese slowdown affecting the worldwide equity market, and slower-than-expected online gambling legalization in the US and lower growth levels in Macau causing sector-specific headwinds, the drop in gambling stocks is not surprising.

But for several gambling stocks who have lost 20-30% of their value in a matter of weeks, the recent bearishness seems overdone. For long-term investors who understand the key drivers of the worldwide casino industry (which, in some order, are Asia, Asia, Asia, and Asia) buying opportunities have opened up as a result of the recent weakness in the sector. Here a couple of stocks available for purchase, at new, lower prices:

Scientific Games (SGMS)

When you follow the stock market long enough, you realize just how often investors seem to forget what it is they already know. Such is the case with Scientific Games, which rose over 50% in the five weeks after the late December DOJ opinion re-defining the Wire Act. That opinion was sparked by a request from the state of Illinois, who along with New York, was hoping to institute online sales of its lottery tickets. The primary vendor for instant tickets in both states was none other than Scientific Games, and investors correctly realized that the direct benefits to SGMS of the opinion were far more valuable than the still-illusory potential of a market for online poker and other forms of gambling.

After relatively disappointing fourth quarter earnings, SGMS slipped, but managed to stabilize between $11 and $12 per share. But as the broad market turned downward in early May, the stock tumbled, falling over 20% before a recent rebound after more positive first quarter earnings. SGMS closed Friday at $8.88.

At that level, SGMS now trades lower than it did immediately following the DOJ announcement. Yet what has changed over the past five-plus months? The benefits of online lottery sales are still on the horizon; in the meantime, the company saw its net loss narrow in 2011 (while free cash flow rose), while posting year-over-year revenue increases of 13% and 19% in Q42011 and Q12012, respectively. Furthermore, the economic worries that have hurt casino stocks should have a far lesser impact on lottery revenues, which have in the past proved to be relatively “recession-proof” (though 2008’s severe downturn proved to be an exception.)

It’s true that SGMS saw weaker-than-expected earnings in the first quarter (though the stock still rose) and its debt load is higher than some would like (about $15 per share including long-term liabilities, net of cash). But few companies in the sector are in better position to take advantage of some of the secular growth trends in the gambling sector. The company’s Chinese operations saw strong growth in 2011 (though revenue in the country was flat year-over-year in Q1 of 2012) and its strong place within the US lottery system was emphasized this week when the state of Pennsylvania chose Scientific Games as its consultant for a potential privatization initiative. US online legalization stands a good chance of going through its lottery system – having the funds go to education or programs for the elderly will make iGaming an easier sell politically – and SGMS will almost certainly benefit. It’s not often that I will recommend an unprofitable, indebted company; but Scientific Games simply has too many avenues for growth to be ignored. At a 25% discount to its still-reasonable trading price in April, it’s just too good to pass up.

Macau operators

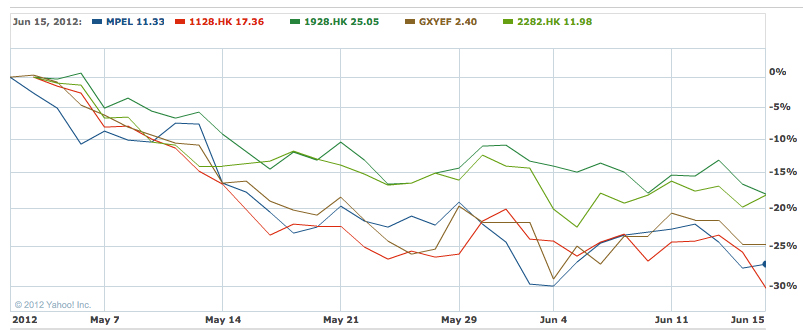

Stock price chart since May 1st; Melco Crown Entertainment (MPEL) in blue; Wynn Macau (1128.HK) in red; Sands China (1928.HK) in dark green; Galaxy Entertainment (GXYEF) in brown; MGM China (2282.HK) in light green; chart courtesy Yahoo! Finance.

With growth slowing substantially in May amid fears of a “hard landing” for the Chinese economy, Macau-facing casino stocks have been hammered, down 18-30 percent in the last six weeks. For long-term investors, this represents an excellent buying opportunity.

Even if the Chinese economy does slow down, the country will still be minting new millionaires at a rate unheard of in human history. Experienced operators like Las Vegas Sands and Wynn Resorts will be able to adapt – by focusing more on the nearly virgin mass market segment over the legacy VIP customer, expanding non-gambling revenue such as entertainment and restaurant spending, and adding more rooms, more experiences, and more tables to their operations. And even lower-than-expected growth in Macau still dwarfs the potential anywhere else – Nomura Securities’ Harry Curtis cut his 2012 and 2013 growth rates to 15 and 11 percent, respectively, still well ahead of the near-zero-growth markets in the West. Despite the lower growth projections, Curtis still predicted 40% gains over the next year for Las Vegas Sands (LVS), MGM Resorts (MGM), and Wynn (WYNN) as they rebound from their recent weakness.

I’ve covered the bull case for Macau at length here at CalvinAyre.com, and most observers even casually familiar with the gambling industry are well aware of the island’s importance. Slightly slower growth and worldwide economic worries simply don’t change the fact that Macau is the most profitable gambling market in the world. In the past, I’ve chosen Galaxy Entertainment as a top pick on the island, and more recently chose LVS over WYNN after pushing WYNN for much of the first quarter. But with a 20-30% discount from recent prices, and the market potential in Macau still largely intact, any of the stocks with operations on the island – whether the Hong Kong-listed subsidiaries or the US parents – are worth at least a long look from investors. (This excepts MGM and MGM China, whose large US debt and low Chinese market share should make those stocks laggards going forward.) There is simply no reason why Macau-facing casino stocks should have taken the beaten they have over the past six weeks. Eventually, the market will realize its mistake.

NagaCorp (3918.HK)

The Cambodian casino operator has had a roller-coaster 2011; the stock rose 90% to start the year, climbing over HK$4 per share thanks in large part to better-than-expected 2011 earnings. In March, I noted the company’s potential, but also argued that investors should wait for a pullback before considering investing in the high-risk, high-reward stock. Three weeks later, NagaCorp raised some HK$214 million through a secondary stock offering, priced between $3.04 and $3.18; the stock fell some 25%, though it has regained some ground since then.

At Friday’s close of HK$3.20, the stock remains an interesting, albeit highly speculative play. 2011 earnings were HK$0.35 per share, putting its price-to-earnings multiple below 9. That multiple will likely increase substantially, given the additional 70 million shares, but the added cash will give the company opportunities for new ventures – such as a potential location in Thailand, should that market open up. In the meantime, NagaCorp’s monopoly on operations in Phnom Penh, exceptionally favorable tax agreement, and earnings growth make the stock an excellent choice for the speculative portion of one’s portfolio. But the political uncertainty in the country and the intense competition in Southeast Asia means investor should only invest in NagaCorp money they can afford to lose.

Global Cash Access (GCA)

I haven’t yet covered Global Cash Access, which provides ATM and credit card advance terminals to casinos. GCA had been one of the market’s best-performing stocks, tripling between October and April, as strong earnings finally awakened investors to the company’s traditionally strong cash flow. But first quarter earnings appeared to disappoint the Street – despite beating expectations – and the stock turned with its peers, dropping 20% from its 52-week high set in late April.

At Friday’s close of $6.92, GCA looks to have another strong run ahead of it. In conjunction with Q1 earnings, the company re-affirmed its full-year earnings guidance between 76 and 82 cents per share in so-called “Cash EPS” (earnings less one-time items). At the midpoint of that guidance, GCA trades for less than 9 times forward earnings.

But it’s GCA’s cash flow that makes the stock really worth a look. Free cash flow was over 10% of the company’s market capitalization in 2011, with the first quarter of 2012 easily surpassing the year-ago figure. Its US focus means the company won’t see significant growth, but the continuing addition of casinos nationwide in markets such as Massachusetts, Washington, DC, and Ohio mean new markets for GCA terminals. The company has a modest amount of debt and no dividend, but as cash continues to come through the doors, that may change. In the meantime, GCA’s recent drop has created yet another gambling stock that is available at a discount to its true value