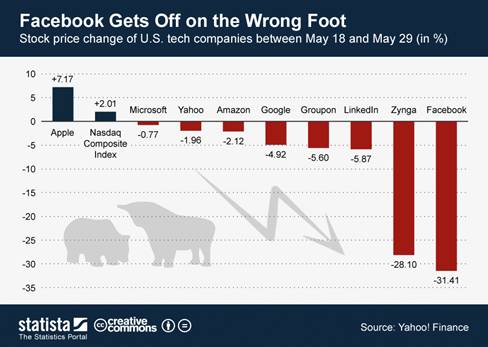

There aren’t many certainties in life. One of those that were supposed to be was making money off shares in Facebook. A piece of Mark Zuckerberg’s company was supposed to pay, in one fell swoop, for all those expensive porn site subscriptions and bar tabs that you’ve racked up over the years. As we now know the listing didn’t go ahead as planned and the shares now find themselves in the doldrums. Statista’s latest chart of the day shows just how bad things have got for Facebook, and their tag-along Zynga, in the past week.

The drop of 31.41 percent wasn’t on the lips of anyone and will have left those tipping the stock for big things red-faced. It’s at times like these that listed firms usually reach for the “Idiot’s Guide to Boosting Your Stock” and make an announcement of some new product, innovation or deal designed to boost confidence. What will it be though?

Rumours so far this week have seen the Facebook phone mentioned as a possible savior for their mobile aspirations. That in itself would require a great deal of work from their side of the fence and trying to challenge Apple and Google may not go down to well with those precious shareholders.

The other option we pushed forward yesterday was getting in the sack with either Apple or Google to see where that takes them. Interestingly, in a interview Apple CEO Tim Cook gave with All Things D, the new man at the helm admitted that their relationship with Zuckerberg’s pet was “very solid” and to “stay tuned”. This would hint at cooperation between the two sides on Apple iOS 6 and could be the kind of deal that might just push the share price up just a little bit.

One party to be suffering over no fault of their own is the social gaming industry firm Zynga. Their stock has dropped 28.1 percent since Facebook’s shares hit the market and it doesn’t look like halting any time soon. The gaming industry itself is watching on with intrigue and it was just last night that bwin.party decided to invest millions in this side of the industry.

Whatever Facebook does next will be scrutinized and you’ll be able to tell how successful it’s been by where the stock ends up.