UK-listed gambling giant GVC Holdings is trying to reassure investors that media speculation involving the company’s links to disgraced online gambling payment processor Wirecard is fake news.

UK-listed gambling giant GVC Holdings is trying to reassure investors that media speculation involving the company’s links to disgraced online gambling payment processor Wirecard is fake news.

GVC’s shares sunk nearly 9% in Thursday’s early trading on the London Stock Exchange, and while the shares have staged a minor rebound, they’re currently sitting around 5% below Wednesday’s close.

The drop appears to have been caused by a speculative op-ed in the Times by Alistair Osborne. The op-ed cited a theory by some short-sellers who wondered if there was some connection to Wirecard in the recent announcement by Her Majesty’s Revenue & Customs (HMRC) that it was “widening the scope of its investigation” into GVC’s former Turkish-facing operations.

Wirecard, which made a name for itself by dealing with ‘controversial’ sectors such as online porn and gambling, imploded last month after management was found to have been fudging the books to show $2b in reserves that didn’t actually exist.

GVC acquired rival Bwin.party digital entertainment in 2015, which included the latter firm’s payment processing unit Kalixa. GVC unloaded Kalixa the following year but the unit continued to handle payments for GVC’s betting brands. GVC reportedly declined to specify to the Times whether Kalixa, now known as PXP Financial, is still handling GVC’s online payments.

The Times article noted that Senjō Group Pte Ltd, the Singaporean firm that acquired Kalixa from GVC, is currently under investigation for its role as a ‘third-party acquiring partner’ of Wirecard. Such third-party arrangements allowed Wirecard to continue collecting commissions on transactions involving sectors with which it no longer wished to be publicly associated.

In 2019, GVC effectively gave away its highly lucrative but legally sketchy Turkish-facing operations to an individual connected with GVC’s former CEO Kenny Alexander, who abruptly retired just days before the HMRC announcement. Last summer, GVC felt compelled to deny public reports that it was somehow still benefiting from its former Turkish business.

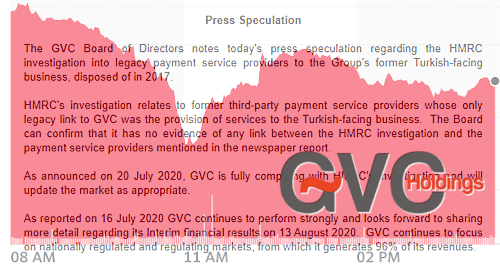

On Thursday, GVC issued a brief statement saying that the HMRC probe “relates to former third-party payment service providers whose only link to GVC was the provision of services to the Turkish-facing business.” GVC added that “it has no evidence of any link between the HMRC investigation and the payment service providers mentioned in the newspaper report.”

GVC reiterated that it was “fully complying” with the HMRC probe and would update the market as warranted. The company is scheduled to hold an analyst call on August 13 to discuss its H1 results, which GVC said would emphasize the 96% of revenue generated from “nationally regulated and regulating markets.”