Online gambling operator LeoVegas lost €3m in the final quarter of 2019 but insists it has taken the necessary steps to adapt to the “challenging external environment.”

Online gambling operator LeoVegas lost €3m in the final quarter of 2019 but insists it has taken the necessary steps to adapt to the “challenging external environment.”

Figures released Friday show the Stockholm-listed LeoVegas generated revenue of €87.1m in the final three months of 2019, up 3% from the same period last year. Earnings were up 79% to €14.5m thanks to the sale of Authentic Gaming last October. Absent that boost, adjusted earnings were up €1.1m to €9.2m and the company booked a net loss of €3m for the quarter.

Outside of the UK, LeoVegas said its Q4 revenue was up 11% year-on-year. The company announced a restructuring of its UK business last month to migrate its brands onto a single tech platform while the company previously announced it was pulling its Royal Panda brand from the market. These moves resulted in a €6.1m hit to Q4’s earnings.

Other factors weighing on the Q4 results were the ongoing challenges presented by Sweden’s new regulated market and the “removal of a key payment services provider” in Germany. However, German operations are said to be on the rebound as customers discovered “alternative payment methods.”

LeoVegas’ share of revenue from locally regulated markets shot up 22 points to 55%, an all-time high. But locally regulated means locally taxed, and Q4 taxes nearly doubled year-on-year to €13.2m.

For 2019 as a whole, revenue rose 9% to €356m, earnings gained 19% to €49.5m while profit plunged 78% to €9.5m, although adjusted profit was down a mere €2.2m to €31m.

A year ago, LeoVegas was calling 2018 the “most challenged year” in the company’s seven-year history. This year, CEO Gustaf Hagman was musing about the challenges of navigating “an increasingly complex world” and announcing that LeoVegas had decided to “remove our financial targets for 2021.”

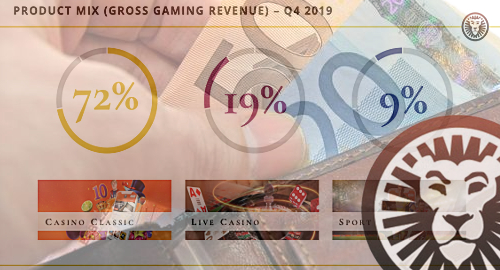

LeoVegas is going back to its roots by focusing more on its online casino vertical through the launch of new brands such as the Swedish-facing GoGo Casino, which Hagman said has “exceeded our expectations” as the company’s Swedish revenue hit a “new record high level” in December.

Despite that record, Nordic market revenue as a whole was down 1% in Q4, while other European markets were down 6%. Fortunately, the Rest of World segment was up 43% year-on-year, although this was down 12% from Q3.