Greek lottery and betting operator OPAP saw its profits spike by nearly one-quarter in Q3 as its surging video lottery terminal (VLT) operations offset a sports betting slowdown.

Greek lottery and betting operator OPAP saw its profits spike by nearly one-quarter in Q3 as its surging video lottery terminal (VLT) operations offset a sports betting slowdown.

Figures released this week show OPAP generated revenue of €393.6m in the three months ending September 30, up 6.7% from the same period last year. But earnings jumped 16.5% to €101.6m and net profit shot up 24.5% to €48.8m thanks to the company’s ongoing purge of all unnecessary expenses.

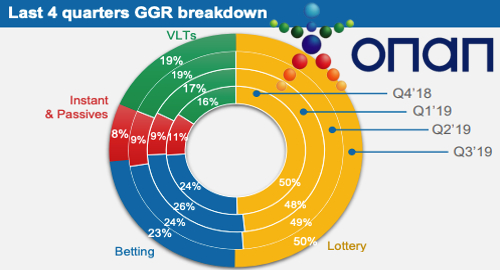

Lottery products remain OPAP’s bread-and-butter, although the segment’s share of overall revenue dropped 1.3 points to 50.1% in Q3. Lottery revenue was up 4.1% to €197.4m thanks to “the lasting positive effect of KINO enhancements,” as well as an improved showing by its Joker product, which made its online debut this year. The Instant & Passives segment gained 1.8% to €31.6m.

Sports betting revenue slipped 5.7% year-on-year to €91.9m, pushing its share of overall revenue down 3.1 points to 23.3%. OPAP blamed a poor comparison with Q3 2018, which featured the latter stages of the FIFA World Cup, as well as “virtual games’ natural attrition.”

OPAP had a total of 6,616 Playtech-powered self-service betting terminals (SSBT) in Greece and Cyprus as of September 30, and their share of betting revenue jumped nearly six points year-on-year to 19.5% in Q3. The SSBT share of live betting revenue jumped nine points to nearly 34%.

OPAP’s ongoing rollout of new VLTs continues to be the engine driving the boat, as revenue shot up 43.2% to €72.8m, boosting the VLT share of overall revenue by nearly five points to 18.5%. OPAP had 20,932 VLTs installed in Greece by the end of Q3 and expects to have the remaining 4k or so units installed before the year is through.

While marketing costs were up 28.7% in Q3 they are down 0.4% for the year-to-date, and a rise in payroll expenses was mostly due to golden handshakes from a voluntary redundancy scheme, meaning staffing costs will start to tumble soon. Other operating expenses were down one-fifth, thanks to a 36.7% fall in IT-related costs following the conclusion of OPAP’s recent “technology transformation.”

Earlier this month, the Hellenic Competition Commission gave its approval for OPAP taking a majority stake in TCB Holdings, the parent company of the Stoiximan Group, which operates online in Greece and Cyprus under its own brand and in other European markets under its Betano brand. The acquisition still requires a thumbs-up from competition watchdogs in Cyprus.

As for OPAP’s pending acquisition by Czech gaming operator Sazka Group, OPAP says Sazka had increased its OPAP stake by an additional 7.25% as of October 31, giving Sazka a roughly 40% stake in OPAP.