UK-facing online gambling operator Sky Betting & Gaming (SBG) has confirmed its status as a global heavyweight, making the future look very bright indeed for soon-to-be-owner The Stars Group (TSG).

UK-facing online gambling operator Sky Betting & Gaming (SBG) has confirmed its status as a global heavyweight, making the future look very bright indeed for soon-to-be-owner The Stars Group (TSG).

On Monday, TSG and SBG teamed up to present SBG’s latest financial performance figures through TSG’s ‘business acquisition report.’ TSG announced its $4.7b deal to acquire SBG in April, although it’s still waiting for the UK’s Competition and Markets Authority (CMA) to sign off on the deal.

However, the companies announced Monday that the CMA had released them from its initial enforcement order on Friday, thereby allowing them to proceed with their planning of the integration of the two companies, if not the actual process of integration. Baby steps.

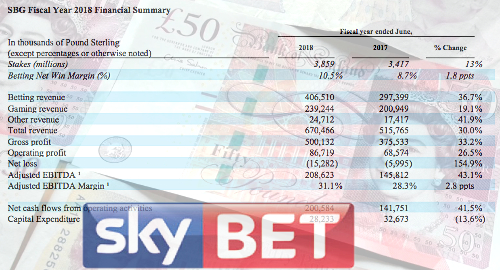

SBG reported revenue of £670.5m in the 12 months ending June 30, a 30% improvement over the previous fiscal year’s result. Adjusted earnings shot up 43% to £208.6m and operating profit was up more than one-quarter to £86.7m.

Revenue gains were strong in both the betting (£406.5m, +36.7%) and gaming (£239.2m, +19%) verticals, while the ‘other’ category was up 42% to £24.7m. Overall average quarterly active unique customers (QAUs) were up 17% year-on-year to 1.8m, which SBG credited to new products and existing product enhancements.

Betting stakes were up 13% to £3.85b and margins improved 1.8 points to 10.5% thanks to operator-friendly results, particularly in European football. The 2018 FIFA World Cup generated revenue of £33m as 1.3m active unique customers placed wagers with SBG during the tourney.

A quarter-by-quarter look at SBG’s revenue shows that an oversized chunk (£193m) of its annual total came in the three months ending December 30, during which betting revenue spiked 103% year-on-year and margins hit 14% (50% above normal expectations). Combined with a 28% rise in gaming revenue, fiscal Q2’s earnings were up 230% year-on-year to £77m, nearly 37% of the full-year figure.

Worryingly, SBG’s fiscal Q4 – which included the first 14 days of World Cup action – saw betting stakes fall 4% year-on-year thanks to lower spend per customer. The company blamed the aforementioned operator-friendly results for depleting customers’ wagering budgets.

Similarly, while Q4 gaming revenue was up 8% year-on-year, the vertical suffered from reduced cross-sell from those broke-ass sports bettors. The net result was flat Q4 earnings as earnings margin fell 4.6 points due to the need to heavily promote SBG’s World Cup offering.

Other UK operators have blamed similar slowdowns on having taken their punters to the cleaners in the December quarter, but perhaps it speaks to the overall market reaching or at least nearing capacity. And it sets up most operators for a mighty fall in Q4 2018 should their betting margins fall back to earth.

Regardless, TSG CEO Rafi Ashkenazi remains dead pleased at the prospect of adding SBG’s UK heft to its bottom line, calling 2018 was “a transformative year” for his company and SBG “a key component” of TSG’s plan for global domination.

Similarly, SBG CEO Richard Flint hailed “another strong year” for his company that saw SBG extend its “leadership as the UK’s most popular online betting and gaming brand.”