Spain’s fledgling online gambling market struggled in the second quarter of 2013, underscoring what the Spanish gambling regulator described as the continuing “reduction/stagnation” of the country’s online action. Given that Spain’s online gambling market launched in June 2012, there are no comparable year-on-year figures from which to draw conclusions and sequential comparisons are difficult given seasonal fluctuations. But La Dirección General de Ordenación del Juego (DGOJ) reported gross online gaming revenue of €55.4m in the three months ending June 30, off 10% from Q1’s tally, while turnover fell 7% to €1.3b.

Spain’s fledgling online gambling market struggled in the second quarter of 2013, underscoring what the Spanish gambling regulator described as the continuing “reduction/stagnation” of the country’s online action. Given that Spain’s online gambling market launched in June 2012, there are no comparable year-on-year figures from which to draw conclusions and sequential comparisons are difficult given seasonal fluctuations. But La Dirección General de Ordenación del Juego (DGOJ) reported gross online gaming revenue of €55.4m in the three months ending June 30, off 10% from Q1’s tally, while turnover fell 7% to €1.3b.

The worrying signs aren’t confined to monetary amounts. Registered player figures rose 15% from Q1, but new signups have fallen from a monthly average of 176k in the last six months of 2012 to just 126k in the first half of 2013. The average of active monthly players in H1 2013 has seen a similar drop-off, falling to 279k from H2 2012’s 407k.

Online sports betting revenue declined 13% from Q1 to €26.8m, although much of this can be attributed to the end of another football season during Q2. Poker revenue fell from €17.9m to €16.4m as tournament spending fell 12% and cash games were off 7%. Casino revenue fell 4% to €8.5m, while bingo defied the odds with €1.8m in revenue, up €100k over Q1. Viewed in terms of market share, sports betting accounted for 48.4% of revenue, poker potted 29.6% (cash games 20%, tournaments 9.6%), casino claimed 15% and bingo bagged 3.2%.

Spain’s struggling regulated online market could get a shot in the arm if Spain decides to follow the Dutch model by fining operators not holding Spanish licenses. Earlier this week, a Spanish gaming lawyer told eGaming Review that the DGOJ was preparing punitive action against as many as 15 unlicensed operators, who would face “huge” fines for continuing to defy Spanish authorities. How huge? The DGOJ has previously threatened unlicensed operators with fines of between €1m and €50m. eGR’s source said the first fines would be issued “in the next few months.”

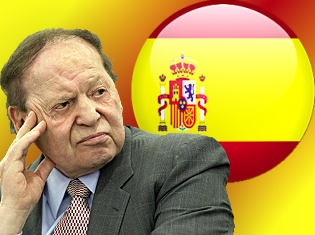

SPAIN TELLS ADELSON TO BUTT OUT

On the terrestrial gaming front, the Spanish government has attempted to head off criticisms that it was bending over backward to accommodate Las Vegas Sands. In May, it was reported that Sands’ titan Sheldon Adelson was personally lobbying and/or threatening Spanish Prime Minister Mariano Rajoy in a bid to exempt Sands’ proposed EuroVegas resort-casino development in Madrid from Spain’s tough anti-smoking laws.

In late July, a Rajoy representative issued a written statement to Spanish legislators assuring them that the government had “not planned for modifying the current anti-tobacco law” and that it remained committed to promoting “the health of its citizens and the prevention of diseases caused by tobacco.” Seasoned parsers of pol-speak will note that ‘not planned’ doesn’t rule out the possibility of future plans, and that promoting the health of one’s citizens could technically be accomplished by putting up a few ‘smoking is bad’ posters.

While Spain’s smoking laws are a matter for the Central government to decide, the increasingly desperate local government in Madrid has already said it will jump however high Adelson demands in order to ensure the short- and long-term economic benefits expected to come from hosting the EuroVegas resort. Good thing, then, that Madrid has no power to grant Adelson’s request/demand that Spain shut down its domestic online gambling market. Tune in tomorrow, when Adelson demands that Spain agree to military intervention in Syria or he’ll relocate EuroVegas to some city in newly bellicose France.