Kenya has imposed new taxes on gambling operators after mounting concerns over the proliferation of gambling and the idea that the government was not getting its cut. On Tuesday, Kenya’s parliament approved a new Finance Bill, which will require betting firms to pay 7.5% of net revenue, while gaming companies will pay 12% and lottery operators will pay 5% of turnover. The new tax regime could take effect as early as next week. The tax changes were originally part of a new Betting, Gaming and Lotteries Bill, which had undergone second reading in Parliament last week. But the bill was scrapped and its tax provisions were transferred to the Finance Bill at the request of the the Treasury. New gambling legislation that will impose tighter regulations on the sector is reportedly under development. Kenya has one of Africa’s more liberal gambling markets, having witnessed the launch of the first domestic online betting site way back in 2011. There are now over a dozen digital platforms catering to Kenyans’ gambling needs. Some Kenyan operators have even begun to expand internationally, including SportPesa, which made a splash this summer by inking two English Premier League partnerships, including a shirt deal with Hull City FC. Mobile money transfer statistics demonstrate the growing clout of Kenya’s digital betting market. According to the Central Bank of Kenya, the volume of cash moving through mobile platforms grew by one-fifth over the first half of 2016, and telecom operators believe the country’s bookmakers are primarily responsible for the surge. Adil El Youseffi, CEO at Airtel Kenya, told Business Daily Africa that betting transfers were among the top transactions at his company, “especially over the weekends and when the English Premier League is on.” In March, Airtel partnered with SportPesa to allow bettors to place wagers with Airtel Money with no transaction charge (punters still have to pay to withdraw funds in cash). Safaricom CEO Bob Collymore, whose company offers the popular M-Pesa mobile money transfer service, says mobile sports betting had “absolutely overtaken everyone else” in terms of volume. Collymore said the majority of betting transactions are quite small, between Sh20 and Sh100 (US $0.20 to $1), but low-rolling Kenyans tend to place multiple wagers at a time. To understand just how mad for it Kenya’s bettors are, the local Betting Control and Licensing Board estimates that 5m Kenyans – 12.5% of the country’s 40m mobile money users and 11% of the total population – have engaged in mobile betting.

Kenya has imposed new taxes on gambling operators after mounting concerns over the proliferation of gambling and the idea that the government was not getting its cut. On Tuesday, Kenya’s parliament approved a new Finance Bill, which will require betting firms to pay 7.5% of net revenue, while gaming companies will pay 12% and lottery operators will pay 5% of turnover. The new tax regime could take effect as early as next week. The tax changes were originally part of a new Betting, Gaming and Lotteries Bill, which had undergone second reading in Parliament last week. But the bill was scrapped and its tax provisions were transferred to the Finance Bill at the request of the the Treasury. New gambling legislation that will impose tighter regulations on the sector is reportedly under development. Kenya has one of Africa’s more liberal gambling markets, having witnessed the launch of the first domestic online betting site way back in 2011. There are now over a dozen digital platforms catering to Kenyans’ gambling needs. Some Kenyan operators have even begun to expand internationally, including SportPesa, which made a splash this summer by inking two English Premier League partnerships, including a shirt deal with Hull City FC. Mobile money transfer statistics demonstrate the growing clout of Kenya’s digital betting market. According to the Central Bank of Kenya, the volume of cash moving through mobile platforms grew by one-fifth over the first half of 2016, and telecom operators believe the country’s bookmakers are primarily responsible for the surge. Adil El Youseffi, CEO at Airtel Kenya, told Business Daily Africa that betting transfers were among the top transactions at his company, “especially over the weekends and when the English Premier League is on.” In March, Airtel partnered with SportPesa to allow bettors to place wagers with Airtel Money with no transaction charge (punters still have to pay to withdraw funds in cash). Safaricom CEO Bob Collymore, whose company offers the popular M-Pesa mobile money transfer service, says mobile sports betting had “absolutely overtaken everyone else” in terms of volume. Collymore said the majority of betting transactions are quite small, between Sh20 and Sh100 (US $0.20 to $1), but low-rolling Kenyans tend to place multiple wagers at a time. To understand just how mad for it Kenya’s bettors are, the local Betting Control and Licensing Board estimates that 5m Kenyans – 12.5% of the country’s 40m mobile money users and 11% of the total population – have engaged in mobile betting.

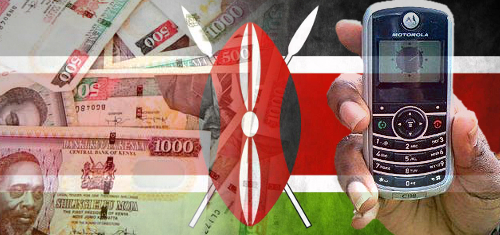

Kenya imposes new gambling taxes; mobile betting leads to surge in money transfers