US sports bettors are more likely to bet with a non-approved bookmaker on this season’s National Football League action, despite increased access to locally licensed betting options.

US sports bettors are more likely to bet with a non-approved bookmaker on this season’s National Football League action, despite increased access to locally licensed betting options.

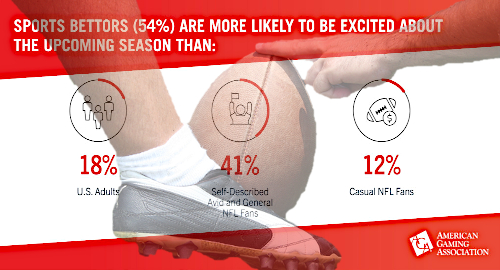

On Wednesday, the American Gaming Association (AGA) released the results of a new survey into Americans’ 2020 NFL betting plans. The survey of 2,200 adults showed 54% of bettors are stoked about the new NFL season – which kicks off Thursday – versus just 41% of ‘avid and general’ NFL fans and just 18% of the general US population.

The numbers aren’t really a great surprise, as numerous surveys have shown bettors are far more dedicated consumers of NFL broadcasts than non-bettors.

But some 42% of US adults are actually less enthusiastic about the 2020 NFL season, with the increased politicization surrounding the game cited as the primary cause (36%) of this waning appeal. Other contributing factors were the absence of fans in the stands (19%) and the inability of fans to congregate with friends to watch games (17%) due to COVID-19 pandemic restrictions.

Of the 33.2m US adults who say they’ll wager money on NFL games this season, 20% will wager at US-licensed land-based sportsbooks, two points higher than last year. More than one-third (34%) will wager online – through both locally licensed and internationally licensed operators – up from 29% in 2019.

But the biggest gain came from the 18% of US bettors who plan to wager with “a bookie,” aka an individual or website not holding a US license, up six points year-on-year. Meanwhile, informal pools and fantasy contest participation is expected to fall five points to 26% and those who bet with friends, family or co-workers will slip three points to 50%.

The AGA attempted to explain the surge in unauthorized wagering on bettors who are clueless about what’s legal and what’s not. A survey released this summer showed more than half (55%) of bettors who wagered with internationally licensed operators didn’t believe they breaking any laws (and technically they aren’t, as it’s not illegal to place wagers, only to accept them).

The AGA recently reported that US-licensed sports betting revenue in July was up 86.2% year-on-year to $69m, although that’s still a drop in the bucket compared to online gambling ($143m, +253.6%), land-based slots ($1.9b, +26.8%) and table games ($482m, -36.3%).

US bettors are expected to be deluged with locally licensed bookmakers’ commercial pitches this season, running the very real risk of further diminishing non-bettors’ willingness to sit through such promos to watch the on-field product. The expected commercial onslaught also runs the risk of increasing regulatory pushback, as witnessed in numerous European markets, particularly in the UK.