Atlantic City casinos snapped their 21-month revenue growth streak in March following the mid-month closures aimed at stopping the spread of COVID-19.

Atlantic City casinos snapped their 21-month revenue growth streak in March following the mid-month closures aimed at stopping the spread of COVID-19.

On Wednesday, New Jersey’s Division of Gaming Enforcement announced that its nine casinos had generated combined slots and table revenue of slightly under $85.5m, a 61.7% decline from March 2019 and roughly the same slide from February 2020’s total.

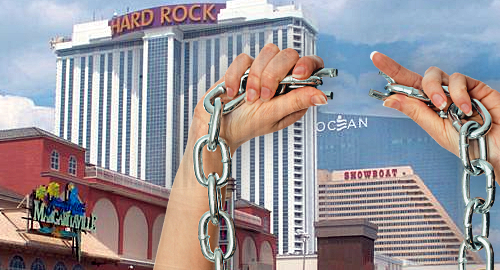

The nine casinos (as well as the state’s three racetracks) were ordered to close their doors mid-month to minimize further COVID-19 transmission, snapping the market’s 21-month streak of annual gaming revenue gains.

The figure would have been much worse without the casinos’ online casino, poker and sports betting options, which added a combined $71.2m to March’s overall total. Counting those digital options, the market’s revenue was down 42.7% year-on-year to $156.7m.

With the exception of the Ocean Casino Resort ($$8.25m, -45.6%), all AC’s casinos saw their individual revenue fall by more than half in March. The Borgata posted the largest percentage decline (-67.5%) but managed to retain its spot atop the brick-and-mortar revenue chart with $19.3m.

The Tropicana ($10.25m, -62.5%) just pipped the Hard Rock Atlantic City ($10.21m, -58.5%) for the runner-up spot, with Harrah’s ($9.76m, -63.1%) and Caesars ($9.47m, -58.5%) not far behind.

New Jersey has yet to signal when the land-based lockdown might be lifted. State officials confirmed 4,059 new COVID-19 infections and 365 new deaths on Tuesday, the latter figure representing the largest one-day increase since the outbreak began. New Jersey is second only to New York among US states most affected by the pandemic.

Even once the all-clear is sounded, it’s unclear that gamblers will be all that keen on bumping elbows with each other inside AC’s casinos, at least, not at the start. So AC’s recovery may prove as slow as its downfall was fast, particularly if it implements the same safety measures that Macau’s casinos did following their 15-day shutdown in February.

In perhaps a fitting metaphor for AC’s current plight, debris from the derelict Trump Plaza continued to rain down on the boardwalk as the city was buffeted by strong Atlantic winds on Monday. A New Jersey court recently ordered the property’s owner Icahn Enterprises to speed up its demolition plans for the Plaza, which has lain dormant since its September 2014 closure.

MASSACHUSETTS MALAISE

AC’s predicament is far from unique, as Massachusetts’ three casinos all reported sharp revenue declines after the state ordered them to shut their doors on March 15. Wynn Resorts’ Encore Boston Harbor reported revenue of $20.5m in March, a 61% decline from February’s total and barely above the $16.8m the property generated in its first week of operations last June.

MGM Resorts’ MGM Springfield revenue totaled $9.3m, barely one-third of its March 2019 total. The sum was also well below the $21.85m the property reported in February, which was the highest monthly total since May 2019.

Penn National Gaming’s slots-only Plainridge Park Casino reported revenue of $4.75m, nearly 60% lower than its February total. March’s total was less than the $6.1m the property generated in its first week of operations in June 2015.

The shutdown ordered by the Massachusetts Gaming Commission currently extends through May 4, after which the regulator will reassess the situation.