Portugal’s regulated online gambling market returned to growth in the third quarter after suffering its first ever sequential decline in Q2.

Portugal’s regulated online gambling market returned to growth in the third quarter after suffering its first ever sequential decline in Q2.

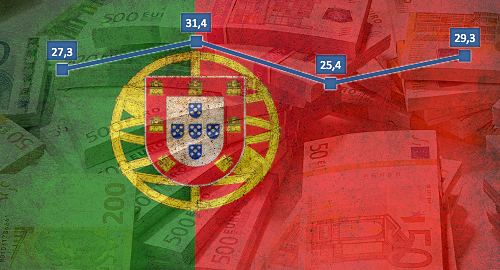

Official figures released this week by the Serviço Regulação e Inspeção de Jogos do Turismo de Portugal (SRIJ) regulatory body show Portuguese-licensed online gambling operators generated combined revenue of €29.3m in the three months ending September 30.

The Q3 total is 15.6% greater than the €25.4m the market generated in Q2 2017, which represented the first sequential revenue decline since Portugal launched its regulated market in June 2016. The Q3 figure is also 21.5% higher than the €24.1m the market reported in Q3 2016, its first full quarter of operations.

For the first nine months of 2017, total online gambling revenue stands at €86.3m, of which the government’s share came to €24.5m. Sports betting accounted for €47.7m of this total, representing roughly 55% of the overall market, with online casino (including online poker) contributed €38.4m.

Q3’s sports betting revenue hit €16.3m, a 16.6% improvement over Q2’s figure. Sports betting had suffered two straight quarters of sequential revenue declines, but the return of football – which accounted for nearly 78% of online sports wagering – gave the numbers a swift kick. On a monthly basis, September’s sports betting revenue hit €7.1m, not far off the current 2017 peak of €7.3m earned in January.

The online casino vertical – again, which includes poker – generated revenue of €13.1m in Q3. While that’s a 15% rise over Q2’s figure, it’s less €800k less than the market generated in Q1. However, on a monthly basis, Q3’s online casino revenue was remarkably stable, with a range of between €4.2m and €4.4m, after soaring as high as €5.4m in January and sinking as low as €3.5m in June.

Slots remain the main casino revenue generator, responsible for about 42% of the overall pie, four points higher than in Q2. Poker cash games ranked second with 22% (down two points), followed by roulette (19.3%, -0.5 points), blackjack (9.1%, flat) and tournament poker (7.5%, -1.2 points).

Roughly 82,400 new customer signups were reported in Q3, reversing the downward trend that had been on display all year. After 411k accounts were opened in H2 2016, Q1 2017 saw new signups slow to 112k, then slowed further to just 64k in Q2.

As of the end of Q3, there were seven companies licensed to operate in Portugal, seven of whom offered casino products while only four offer sports betting. The latest recipient was local betting operator A Nossa Aposta, which received an online slots license for its Nossaposta.pt site in late September. Local brick-and-mortar casino operator Solverde received its online casino license for Casinosolverde.pt a few weeks earlier.