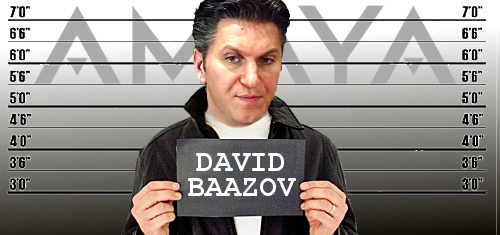

David Baazov, the embattled CEO of Canadian online gambling company Amaya Gaming, has pled not guilty to the insider trading charges filed against him in March.

David Baazov, the embattled CEO of Canadian online gambling company Amaya Gaming, has pled not guilty to the insider trading charges filed against him in March.

On Monday, Quebec securities regulator Autorité des marchés financiers (AMF) confirmed that Baazov (pictured), two other individuals and three companies had formally filed written pleas of ‘not guilty’ to their combined 23 insider trading charges, each of which carries a maximum fine of up to $5m and up to five years in prison.

AMF spokesman Sylvain Theberge told the Canadian Press that the guilty pleas had been received over the past couple weeks and that Quebec courts would soon begin the process of selecting a judge and setting trial dates.

The AMF originally announced that the charges stemmed from suspicious trading patterns in the run-up to Amaya’s 2014 purchase of the parent company of online gambling brand PokerStars and Full Tilt. The AMF later claimed that the sketchy trading dated back to 2010 and involved a total of seven companies.

The AMF alleged that Baazov, who announced he was taking an indefinite leave of absence shortly after the AMF’s expanded investigation was announced, funneled privileged information to his older brother Josh aka Ofer Baazov. The elder Baazov allegedly passed this info on to Craig Levett, who (along with others) reportedly went on to generate $1.5m in illegal profits via timely stock trades.

The elder Baazov and Levett were previously linked to BetonUSA.com, a US-facing online gambling site that appears to have morphed into Oddsmaker.ag following the 2006 passage of America’s Unlawful Internet Gambling Enforcement Act.

Documents uncovered by the International Consortium of Investigative Journalists (ICIJ) linked Oddsmaker’s parent company Zhapa Holdings Inc to yet another Baazov – David and Josh’s sister Goulissa – as well as to Isam Mansour, one of 13 individuals whose stock trading privileges were frozen by the AMF at the same time it announced the insider trading charges.

AMAYA DITCHES LOONIE FOR GREENBACK

In other Amaya news, the company announced Monday that it would be reporting its Q1 financial numbers after the close of trading on Monday, May 16. The company also announced that the Q1 numbers and future earnings reports would be stated in American dollars rather than Canadian.

The Canadian ‘loonie’ has undergone some significant fluctuations in recent months, and Amaya says the currency switcheroo will reduce the impact on reported results and give investors a more accurate reflection of its underlying performance.

To ward off cynics who might suggest Amaya was forcing investors to engage in more complicated computations to determine Amaya’s year-on-year growth – which had been trending negative – Amaya says it will include certain historical data restated in US dollars when it delivers its Q1 report.