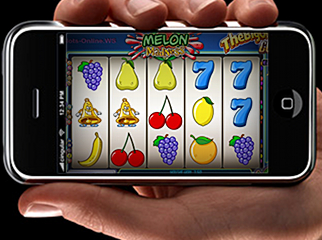

An online gambler won a jackpot of £1.45m playing PartyCasino’s Melon Madness slot last week. Apart from its sheer size, the primo payout is even more significant given that the player in question won it playing on his iPhone, making it the largest mobile slots payday to date and dramatically underscoring the online gambling industry’s continuing shift away from the desktop.

An online gambler won a jackpot of £1.45m playing PartyCasino’s Melon Madness slot last week. Apart from its sheer size, the primo payout is even more significant given that the player in question won it playing on his iPhone, making it the largest mobile slots payday to date and dramatically underscoring the online gambling industry’s continuing shift away from the desktop.

Research firm Gartner says smartphones outsold so-called ‘feature phones’ in Q2 2013, with Asia showing the greatest regional boost in smartphone sales. Smartphones accounted for 51.8% of the 435m mobile phones sold in the three months ending June 30. Those 225m smartphones represent a 46.5% gain over the same period last year, boosted in part by 74.1% growth in the Asia-Pacific market, which easily eclipsed gains made in Latin America (55.7%) and Eastern Europe (31.6%).

Android-powered smartphones dominated the sales ranking with a 79% share. iOS was second with 14.2%, while Microsoft (3.3%) and Blackberry (2.7%) were well off the mark and no other platform scored over 1%. Apple’s slice of the quarterly sales was down from its 18.8% share in Q2 2012, yet it actually sold more units this quarter (31.9m) than last year (28.9m). However, Samsung’s market share not only rose from 29.7% to 31.7% year-on-year, its actual sales figure went from 45.6m to 71.3m.

Meanwhile, Nielsen researchers say Apple remains the most popular smartphone manufacturer in the US, beating Samsung’s 24.7%, although Android holds 52% of US market share by platform (with Blackberry and Windows barely hanging on at 3% and 2% respectively).

The picture is different in China, where analysts at Canalys say Apple has slipped from fifth to seventh on the manufacturers’ chart. Apple’s share of Q2 shipments was just 4.8%, well back from Samsung’s market-leading 17.6% and also lower than a quintet of Chinese firms: Lenovo (12.3%), Yulong (12.2%), ZTE (8.7%), Huawei (8.6%) and Xiaomi (5%).