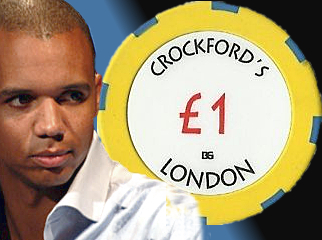

Poker player Phil Ivey has officially been accused of cheating a London casino out of £7.8m. The incident dates back to last August, when the man many feel to be the world’s greatest poker player was playing the punto banco version of baccarat – a game which requires no skill whatsoever – at Crockfords, the self-described world’s oldest private gaming club (now owned by Malaysian gaming operator Genting). Ivey reportedly started off slow, going £500k into the red, but after convincing the casino to boost his wagering limit to £150k per hand, Ivey went on an uninterrupted hot streak that put him very much back in black. The casino sensed something was amiss and refused to pay up beyond returning Ivey’s original £1m deposit, leaving Ivey “no alternative but to take legal action.” Ivey filed suit against Crockfords this week, seeking a total of £12.1m in compensation.

Poker player Phil Ivey has officially been accused of cheating a London casino out of £7.8m. The incident dates back to last August, when the man many feel to be the world’s greatest poker player was playing the punto banco version of baccarat – a game which requires no skill whatsoever – at Crockfords, the self-described world’s oldest private gaming club (now owned by Malaysian gaming operator Genting). Ivey reportedly started off slow, going £500k into the red, but after convincing the casino to boost his wagering limit to £150k per hand, Ivey went on an uninterrupted hot streak that put him very much back in black. The casino sensed something was amiss and refused to pay up beyond returning Ivey’s original £1m deposit, leaving Ivey “no alternative but to take legal action.” Ivey filed suit against Crockfords this week, seeking a total of £12.1m in compensation.

According to the Daily Mail, Crockfords is accusing Ivey of taking advantage of a design flaw in the cards the casino dealt him. Specifically, it is alleged that the factory that manufactured the cards had cut them incorrectly, creating an asymmetrical geographic pattern on the back of the card that allegedly allowed Ivey to perceive the value of certain cards before they were flipped over.

The Mail claims that Ivey’s unidentified female companion, a Las Vegas resident of Asian descent, has been banned from “at least two” casinos. She allegedly told the Crockfords dealer that Ivey was superstitious and wanted the cards turned 180°, which would have exposed the asymmetrical pattern at the corner of each card. When the card in question was flipped over, its value was revealed, allowing someone with a good memory to recognize it when it was returned to the card shoe and re-dealt. Card values of nines and eights are particularly valuable in the game Ivey was playing.

That card manufacturers would occasionally produce a bad batch of cards is understandable. Macau casinos reportedly go through 4.4b playing cards every single year, putting major pressure on manufacturers to keep the production lines humming. That someone would discover a way to capitalize on these mistakes is equally understandable. The question now becomes who will be forced to pay for this mistake.