It’s been three days now since Facebook embarked on both the largest and at the same time most risky IPO in contemporary society and the general consensus is that it’s been a flop. More worrying for some investors will be the fact companies that have a strong interest in what the social network is doing are also falling down as a result. As we reported earlier, Facebook’s shares have dropped 18.4 percent to $31 and for those related to the company it’s bad news.

It’s been three days now since Facebook embarked on both the largest and at the same time most risky IPO in contemporary society and the general consensus is that it’s been a flop. More worrying for some investors will be the fact companies that have a strong interest in what the social network is doing are also falling down as a result. As we reported earlier, Facebook’s shares have dropped 18.4 percent to $31 and for those related to the company it’s bad news.

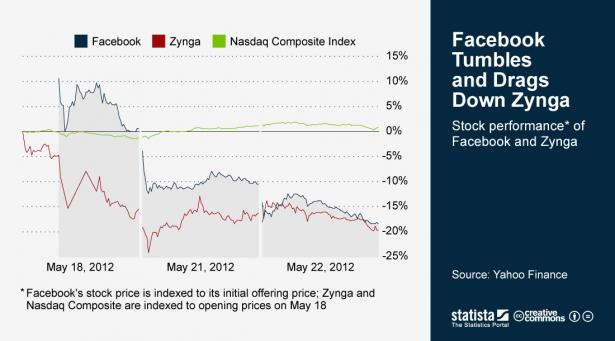

Statista’s chart of the day, which is at the foot of the page, clearly illustrates the shares of Facebook set against one of the world’s largest social gaming firms, Zynga. It doesn’t take a Harvard degree to work out that where Facebook goes Zynga follows and that such a strong relationship with Facebook isn’t doing it any good in the short term. CalvinAyre.com contributor Vince Martin wasn’t wrong describing Zynga as one of the dumbest stocks around. Now that it’s at $6.80 – down from $10 at opening – you can see why.

From a gaming industry point of view, there is a couple of ways to look at the struggles. In the optimism camp, there will be those that say social gaming can come to the rescue and save the day. “Remember when Zynga announced they were thinking about gambling”, is what they will say, along with “just think of the untapped resource of users they have”. Of course the gambling industry could have a great time with the customer base. It’s not as simple as that though.

It wasn’t a coincidence that Zynga said it was interested in gambling came the day after their shares had dropped off massively and it’s not pessimistic to say their main motivation was to drive the share price up. Then there’s the quandary of having to convert free play customers to ones that pay.

There’s the obvious chance that Facebook will start to recover some its pre-IPO value and all the one-night stands/sons/daughters/wives/distant relations (delete as appropriate) will be okay. It started off today back up to just over $32 and Zynga followed suit with a similar rise. So just keep an eye out which way Facebook goes; Zynga is sure to follow.