Sweden’s plans to liberalize its online gambling market would best be served by imposing a revenue tax rate of between 15% and 20%, according to a new industry-funded report.

Sweden’s plans to liberalize its online gambling market would best be served by imposing a revenue tax rate of between 15% and 20%, according to a new industry-funded report.

In a report prepared by Copenhagen Economics, the authors note that the Swedish government has tasked a special investigator with coming up with proposals to help implement the country’s planned shift from an online gambling monopoly to a system that licenses multiple private operators.

The report suggests that the goal of this switch must address two main points: convincing enough international operators to apply for Swedish licenses and channeling online gamblers to these Swedish-licensed sites.

Using a formula of ‘tax-rate x channelization x volumes = tax revenues,’ the report says a high channeling rate (90% or above) is achieved at a tax rate of 15% of gross gaming revenue, and will result in “no significant substitution to gambling operators outside the licensing system.”

A tax rate below 15% may lead to incremental increases in already high channelization, but at the expense of lower tax revenue for the state.

However, a tax rate over 20% leads to channeling rates falling to 80% or below. The net result is lower tax revenue for the state, as operators opt to remain outside the licensing system and gamblers choose to stick with these operators, who will be able to offer more competitive products than highly-taxed Swedish-licensed operators.

The report was prepared on behalf of the Association of Online Gambling Operators (BOS), which is comprised of European Union-licensed online operators that do business in Sweden. The BOS became an affiliate member of the European Gaming & Betting Association in November 2015.

The report notes that few BOS members have bothered to apply for licenses in EU markets in which the tax rate exceeds 20%. Eight BOS members have licenses in the UK, where the online tax rate is 15%, but this number falls to five in Italy (20%), to four in Denmark (20%), dips further to two in Spain (25%), while just one hardy BOS member is operating in France (45%).

The report notes that few BOS members have bothered to apply for licenses in EU markets in which the tax rate exceeds 20%. Eight BOS members have licenses in the UK, where the online tax rate is 15%, but this number falls to five in Italy (20%), to four in Denmark (20%), dips further to two in Spain (25%), while just one hardy BOS member is operating in France (45%).

Looking specifically at the Swedish market, the report says a 20% tax rate will increase operators’ average tax cost by SEK 33m (US $3.7m), or roughly two-thirds of the average operator’s profit margin. A tax rate of 25% or higher would turn these margins into negative territory, which would force operators to pass the costs onto consumers. Smaller operators would be especially affected by high tax rates.

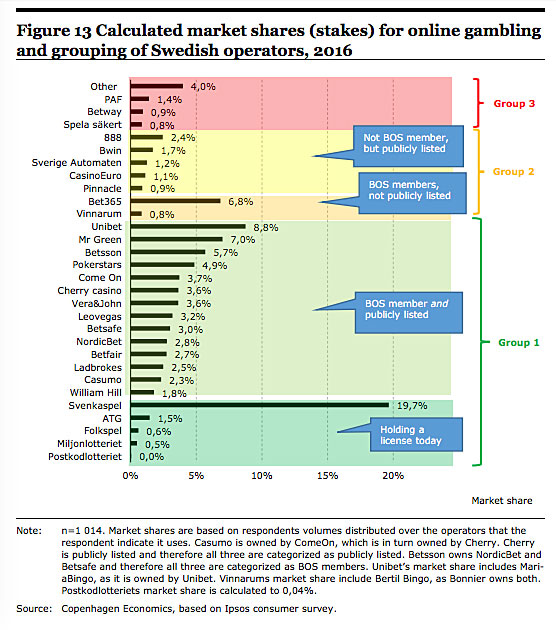

The report also cites Ipsos consumer survey data that shows the state-owned Svenska Spel to be the dominant online gambling operator with a 19.7% share. Runner-up Unibet is well back with 8.8%, followed by Mr Green at 7%, Bet365 at 6.8% and Betsson rounds out the top-five at 5.7%.

Sweden’s government doesn’t expect to announce the specifics of its online liberalization plans until March 2017, after which stakeholders will be given a window of time in which to comment. The current plan is to submit the final draft to parliament by next December and to have it approved before the September 2018 elections.