Australia’s online gamblers could find themselves unable to use credit cards to fund their wagering if the banking industry adopts the findings of a new report.

One year ago, the Australian Banking Association (ABA) announced a consultation to solicit community views on the use of credit cards for gambling transactions. The findings of that consultation have now been released and they could spell trouble for the country’s online betting licensees.

The Every Customer Counts report is based on 40 written submissions from betting operators, gambling counsellors, consumer advocates, academics and government agencies, along with 813 individuals who responded to the short-form web survey.

Most of these responses came down firmly on the side of prohibiting credit card-based gambling, with the report noting the prevailing view that “the associated risks were considered to significantly outweigh any potential benefits for customers, especially for vulnerable populations.”

Some contributors noted that credit cards are already blocked from gambling purchases in land-based gambling venues (casinos, pubs, Tab outlets, etc.) and online betting operators accept debit card payments (which limits punters to spending money they already have).

Those who argued against a ban noted that Australia’s betting industry is already highly regulated and credit card restrictions wouldn’t address the underlying issues behind problem gambling. Concerns were also expressed that a blanket credit card ban could negatively impact some lottery retailers.

A ban could also push punters into the arms of internationally licensed gambling sites, which not only accept credit cards but also offer a much wider variety of gambling products, while Aussie-licensed sites are limited to wagering on human sports, animal races and lotteries.

SURVEY SAYS

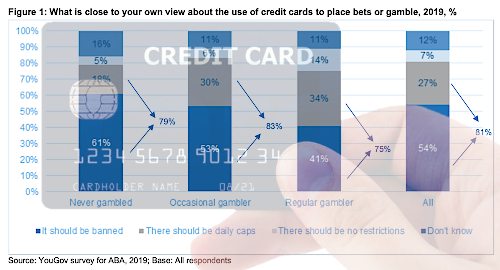

Last year, the ABA commissioned a YouGov survey that found 81% of a random selection of Australians supported either a complete credit card gambling ban (54%) or daily caps on credit card gambling spending (27%). Just 7% felt there should be no restrictions while another 12% couldn’t form an opinion.

There was majority support (75%) for some level of restrictions even among ‘regular’ gamblers who took part in the YouGov survey, with 41% supporting a complete ban and 34% supporting daily caps.

The survey also found that credit card gambling use was highest in the 18-29 age demo, and with one modest deviation in the 50-59 demo, “substantially” declined with advancing age. So perhaps an age-based restriction – if that would pass legal muster – might be more appropriate.

WHAT NOW?

The ABA stressed that the report reflected the views of the respondents, not itself, and it will be up to ABA members to assess the report’s findings and make their own decisions on how to proceed.

One of those members, Bank Australia, announced in October that it would block “all gambling and gaming transactions” on its credit cards effective December 1. Another ABA member, Macquarie Bank, took a similar step in June 2019.

More ABA members may find it harder to resist the pressure to follow these examples, as previous surveys have found over three-quarters of Australians believe banks bear some responsibility for ensuring their customers don’t suffer financial distress as a result of gambling on credit.

Other submissions noted the UK’s April decision to ban credit card gambling – a rule later tweaked to ensure no credit card funding of e-wallets that could then be used for online gambling deposits – and suggested that all credit card issuers, not just Australian banks, need to be on the same page if a ban is going to have any effect.