Portugal’s regulated online gambling market set new revenue records in the first quarter of 2020, which could put further pressure on the government to impose new limits for the duration of the COVID-19 pandemic.

Portugal’s regulated online gambling market set new revenue records in the first quarter of 2020, which could put further pressure on the government to impose new limits for the duration of the COVID-19 pandemic.

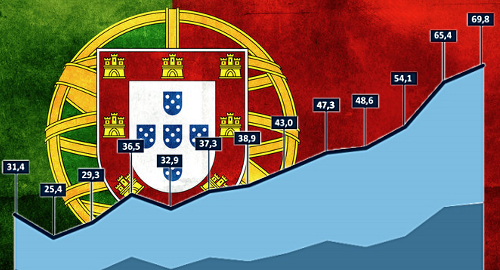

Figures released Thursday by the Serviço Regulação e Inspeção de Jogos do Turismo de Portugal (SRIJ) regulatory body show locally licensed online gambling operators generated revenue of €69.8m in the three months ending March 31, a 47.5% increase over the same period last year and beating the previous quarterly record of €65.4m in Q4 2019.

Portugal’s ten licensed online sports betting operators reported revenue rising 39.2% to €34.5m as betting turnover rose 13.5% to €149m. The turnover figure was down significantly from Q4 2019’s €185.3m, reflecting the suspension of major sports events midway through Q1 due to the pandemic.

The market’s 12 online casino licensees saw revenue shoot up 56.5% to €35.3m as spending hit €960.8m, a nearly 58% boost from Q1 2019 and nearly €100m higher than Q4. Slots accounted for just under 70% of Q1 casino spending, up more than six points year-on-year but basically unchanged from Q4.

The number of pure sports bettors (41.2%) narrowly edged out casino-only customers (39.4%) while a bi-curious 19.4% copped to participating in both verticals.

There were 157,400 new accounts registered in Q1, nearly one-third higher year-on-year but down 6.5% from Q4. The number of gamblers who’d enrolled in self-exclusion programs rose to 52,100, up by 4,300 from Q4.

Earlier this month, Portugal approved legislation that would establish “partial or total limitations on access to online gaming platforms” during the pandemic but the government has been mum about how it intends to implement this legislation. Perhaps that has something to do with the perpetually cash-strapped government’s online tax revenue rising 40% to €20.8m in Q1.

Portugal shut all its land-based casinos on March 14 to limit further COVID-19 transmission. The SRIJ said Thursday that Q1 casino revenue had fallen 17.4% year-on-year to €62m, with March contributing only €9.3m to that total. Slots revenue fell 18.3% to €51m, table games slipped 11.6% to €10.3m and poker tumbled 25.5% to just €689k.