Spain’s online gambling market suffered a slowdown in the final quarter of 2019, as casino games were the only vertical to post year-on-year growth.

Spain’s online gambling market suffered a slowdown in the final quarter of 2019, as casino games were the only vertical to post year-on-year growth.

Figures released Friday by Spain’s Dirección General de Ordenación del Juego (DGOJ) regulatory body show Spanish-licensed online gambling operators generated revenue of €188.5m in Q4, a 2% decline from the final quarter of 2018 and a 3.2% decline from Q3 2019.

Sports betting revenue fell 10.2% year-on-year to €90m in Q4, while declines were also evident in poker (€20m, -4%) and bingo (€2.7m, -24%). Online casino revenue broke the downward trend, rising 11.7% to €72.3m while the minuscule but highly volatile ‘contests’ segment nearly quadrupled to €610k.

The sports vertical suffered mainly from a lack of interest, as betting turnover slipped 9% year-on-year to €1.85b, of which €1.13b was in-play wagering. In-play turnover was down nearly 22% year-on-year, while pre-match betting rose 23.6% to €663.3m.

Online casino spending jumped 14.4% to €2.53b, with slots up 17.6% to €1.13b while live roulette jumped 36% to €779.5m. Traditional roulette wasn’t so fortunate, falling 4% to €377m while blackjack slumped 14.2% to €246.8m.

Online poker was saved from an even greater decline by tournaments, which saw entry fees rise 13.7% to €262.6m while cash games slumped 9.4% to €308.7m.

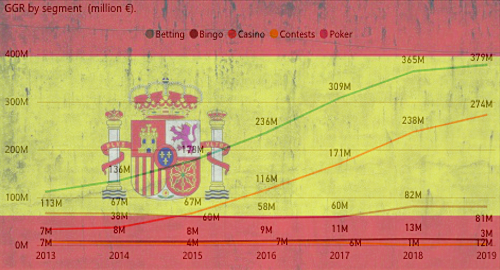

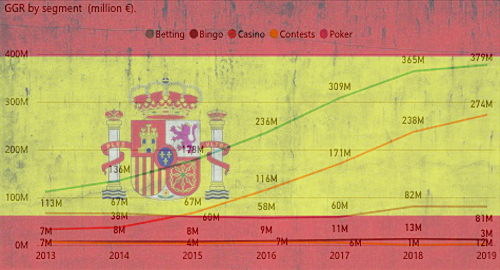

For the year as a whole, total online gambling revenue grew 7.1% to €748.5m, with sports up 3.7% to €378.6m and casino up 15.2% to €273.9m, while poker slipped around €500k to €81.3m and bingo fell 9.7% to €12.1m.

Spain’s online operators registered 301k new accounts in Q4, up 17.7% year-on-year, while active accounts rose 13.3% to nearly 973k. Licensees spent over €56.7m on advertising in Q4, up 10.8% year-on-year. Affiliate spending rose 6.4% to €10.9m while bonus offers were up nearly one-quarter to €39.5m and sponsorship fees shot up 38.8% to €5.8m.

Those numbers will likely start trending downward once Spain implements its new advertising restrictions. Spain’s Minister of Consumer Affairs Alberto Garzón, who unveiled the proposed new rules last week, said he expects they will ultimately prohibit around 80% of current online gambling marketing efforts.

The proposed rules are still being debated but the government is already discussing their implementation with outside forces. Spanish media reported that Garzón had a meeting with Google next week to discuss how to limit Spanish citizens’ exposure to gambling advertisements via the company’s YouTube video platform.

The uncertainty hasn’t deterred gambling operators from seeking Spanish licensing. This week, the DGOJ announced a raft of newly issued licenses, with the lucky recipients including Casumo, Eurasia Solutions, Genting, Rabbit Entertainment, Sisal, Skill on Net and 1xBet.