Online gambling technology provider and operator Gaming Innovation Group (GiG) is in full damage-control mode after its Q3 earnings fell by nearly one-half.

Online gambling technology provider and operator Gaming Innovation Group (GiG) is in full damage-control mode after its Q3 earnings fell by nearly one-half.

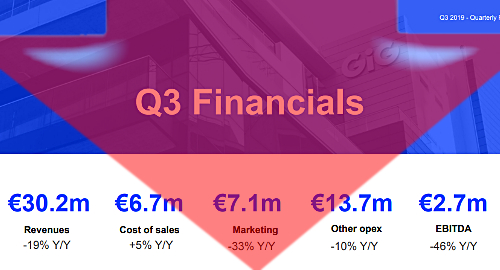

On Wednesday, the Stockholm-listed GiG reported revenue of €30.2m in the three months ending September 30, down 19% from the same period last year, while earnings fell 46% to just €2.7m. The company booked a net loss of €8.35m in Q3 versus a €2.6m loss in Q3 2018.

For the year-to-date, GiG’s revenue is off 19% to €93.6m, while its net loss has nearly tripled to €17.35m despite a one-fifth reduction in operating expenses.

While GiG’s B2C revenue was down 17.2% to €20.2m in Q3, its customer-facing earnings hit an all-time high of €2.4m as its primary Rizk gaming brand performed well everywhere except Sweden. GiG shut Rizk’s Swedish-facing online sportsbook in July due to regulatory uncertainty over the legality of certain betting markets.

GiG’s B2B media services unit reported revenue falling 4.7% to €8m, while earnings were essentially flat at €4.2m. Here again, Sweden played an outsized role, with local B2B revenue falling 23%.

B2B platform services revenue fell by nearly one-half to €3.6m following the termination of a major customer in 2018, resulting in an earnings loss of €2.1m versus a €1.7m positive result in Q3 2018. GiG’s B2B sports betting services unit remains a minnow, with revenue flat at €200k and a net earnings loss of €1.8m for the quarter.

Investors ran for the hills following GiG’s report, pushing the stock down nearly one-fifth to SEK6.41 by the close of Wednesday’s trading. The stock is now worth slightly more than one-third of its SEK18.74 valuation at the start of 2019.

GiG chairman Petter Nylander acknowledged that the industry was “in a bit of a storm” at the moment but stressed that this period was one of “structural change, not a structural decline.” Nylander said it was time for GiG to “adapt to the new reality in order to steer out of the epicenter” of this regulatory maelstrom.

To help steer, GiG has appointed advisors to conduct a strategic review of its operations and “to identify value-creating opportunities, reduce complexity and improve efficiency within the business.”

GiG has already initiated its efficiency push by shutting its proprietary game studio in September after the unit’s revenue generation was deemed “negligible.” The move is expected to trim GiG’s monthly expenses by €250k starting this month.

GiG also announced that Richard Brown, who was appointed acting CEO in September following Robin Reed’s ouster, had now been handed the reins on a permanent basis. Question is, does he still want the job?