Stop us if you’ve heard this one before, but Kenya’s on-again, off-again plans to reduce its new 35% gambling tax are back on-again, at least for today.

Stop us if you’ve heard this one before, but Kenya’s on-again, off-again plans to reduce its new 35% gambling tax are back on-again, at least for today.

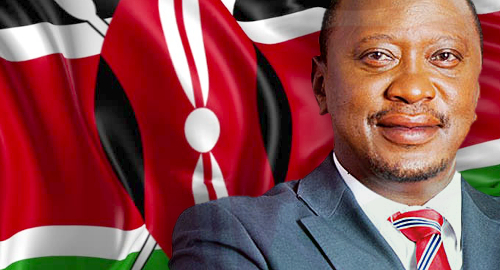

On Monday, Business Daily reported that Kenyan President Uhuru Kenyatta (pictured) had refused to sign the new Finance Bill, 2018, and had instead sent parliament a memo asking them to reintroduce a measure to reduce the country’s new uniform gambling tax rate from 35% to 15%.

If you’re just joining us, Kenyatta himself signed legislation in June 2017 that boosted gambling taxes from as low as 5% (for lotteries) and 7.5% (for betting operators) to a new uniform 35% rate for all gambling products. The new rate officially kicked in on January 1.

Since Kenyatta signed on the bottom line, gaming companies have fiercely lobbied legislators to reduce their tax rate to something they believe doesn’t make their Kenyan operations unworkable. Two such reprieve efforts have already gone down to defeat, including an amendment to the Finance Bill that was rejected earlier this month.

Kenya’s Treasury Secretary had originally sought a truly nutty 50% gambling tax and the 35% rate was a compromise measure proposed by Kenyatta himself. Kenyatta previously resisted efforts to keep taxes at their earlier rates due to his stated desire to curb Kenyan youth’s gambling participation. It’s unclear what might have prompted Kenyatta’s current about-face on this issue.

Business Daily quoted a National Assembly legislator familiar with the contents of Kenyatta’s memo saying there was little appetite in parliament for reopening the gambling tax debate due to the “social impact” of gambling. “This is where we are going to differ with the president.”

The anonymous parliamentarian failed to mention the impact that the tax hike has had on local sports bodies, as large betting operators such as SportPesa cited the tax hike as justification for scrapping its existing sports sponsorships, then renewing some of these deals at reduced rates.

Compounding matters, local sports bodies are complaining that the government has yet to release the portion of the Sh8b (US$79.3m) in new gambling taxes collected that are supposed to help fund their operations. The Standard quoted Sports Cabinet Secretary Rashid Echesa saying that the treasury is waiting for parliament to approve the release of the funds.

The government hasn’t said as much, but it seems logical that officials are delaying the release of the funds until they’re absolutely sure the tax question has been settled once and for all. In the meantime, renovations of sports venues are on hold because contractors haven’t been paid, and the national football team’s head coach hasn’t been paid for two months.