Pennsylvania’s casino operators posted a modest gaming revenue decline in April as action at their gaming tables grew cold.

Pennsylvania’s casino operators posted a modest gaming revenue decline in April as action at their gaming tables grew cold.

Figures released this month by the Pennsylvania Gaming Control Board show the state’s 12 casino operators reported combined gaming revenue of $280.8m in April, down 1.56% from the same month last year. The total is also well off March’s record $300.5m result.

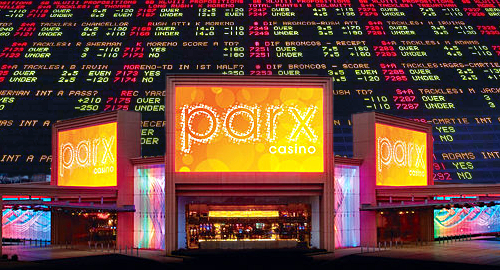

The state’s slot machines did their part to keep the numbers up, with statewide slots revenue inching up 0.2% year-on-year to just under $206.2m. But only four operators were in positive slots territory for the month, led by market leader Parx Casino, which improved 6% to $35.6m, while runner-up Sands Bethlehem dipped 1% to $26.1m.

Statewide gaming table revenue was off 6.2% to $74.6m. Sands led the table charts with just under $17.6m, but this was down nearly one-fifth from April 2017, and barely enough to fend off a surging Parx, which gained 7.1% to $16.5m. Third-ranked SugarHouse was well back of the pace with $10.2m (-1.8%).

Pennsylvania will soon – well, soonish – have at least one more gambling vertical to count, as the state began accepting applications for online gambling licenses last month. It’s anyone’s guess when the state’s online market will actually launch, although it’s looking increasingly dubious that regulators will have all their ducks in a row before the calendar flips over to 2019.

Pennsylvania is also one of the few states that managed to pass sports betting legislation before Monday’s blockbuster ruling by the Supreme Court overturning the federal sports betting prohibition. That gives them a leg up over other states, but it doesn’t mean legal wagering will happen anytime soon.

On Wednesday, Gaming Control Board spokesman Doug Harbach told Philly Mag that the Board has been focused on crafting its online gambling regulatory environment and adding sports betting regulations to that mix will prove “another great challenge for our agency … in the middle of the largest gambling expansion that any other state has ever undertaken.”

Perhaps the delay will allow for some rethink on the issue of taxation. Sports betting is an extremely low-margin activity, and Pennsylvania’s gambling expansion law calls for a preposterously high 36% tax on sports betting revenue. As such, the only tangible gain the state’s casinos can expect from wagering is additional foot traffic, which hopefully spills over into cash spent at their properties’ other amenities.