Gambling industry stakeholders are pushing back against an Indiana legislator’s plan to impose a punitive ‘integrity fee’ on legal sports betting handle.

Gambling industry stakeholders are pushing back against an Indiana legislator’s plan to impose a punitive ‘integrity fee’ on legal sports betting handle.

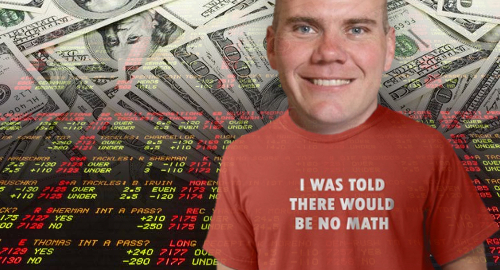

On Monday, Indiana state Rep. Alan Morrison (pictured) introduced HB 1325, a bill to legalize sports betting – including online and mobile wagers – at state-licensed gaming operators if the US Supreme Court strikes down the federal sports betting prohibition.

Morrison’s bill contained a wrinkle heretofore unseen in US gambling legislation: a 1% tax on sports betting handle that would be redirected to the ‘sports governing bodies’ on whose games Indiana punters would be wagering.

This ‘integrity fee’, which would be in addition to a 9.25% tax on betting revenue and a 0.25% federal tax on betting handle, is ostensibly intended to fund efforts to combat match-fixing, point-shaving and other scourges that allegedly accompany legal betting.

Geoff Freeman, CEO of the American Gaming Association (AGA), which represents the nation’s brick-and-mortar casino industry, issued a statement encouraging Indiana to “reject this short-sighted, misinformed idea, which simply replaces a failed federal prohibition with bad state policy.”

Freeman applauded Morrison’s efforts to support legal betting, but insisted that “handing sports leagues 20% of what’s left over after winnings are paid out, undercuts its economic viability.”

Gambling And The Law author I. Nelson Rose further crunched the numbers to determine the impact of a 1% tax on sports betting, and the results make for depressing reading.

Using a decade’s worth of Nevada sportsbook data, Rose determined that the books’ hold – the slice of punters’ wagers the books won – came to 4.16%. The federal 0.25% tax is roughly the equivalent of a 6% tax on betting revenue, which, combined with Nevada 6.75% gambling revenue tax, works out to a total tax obligation of just under 13%.

Using Indiana’s higher gambling revenue tax, along with the 1.25% tax on handle (combining the federal tax and the state’s integrity fee), Rose’s calculations have Indiana sportsbooks paying 39.3% tax on their revenue.

Assuming a book handled wagers of $10m and held 4.16%, the book’s after-tax revenue would be around $250k, from which it would have to pay all its operating expenses. Yeah, good luck with that.

Indiana – and any other states contemplating legal wagering – would do well to consider studies that show a tax rate of 15-20% is optimal for ‘channeling’ punters to locally licensed online gambling operators while still achieving government revenue goals. Set the tax bar higher, and you end up like Portugal, where only 39% of punters wager with locally licensed sites.

For the record, there is a companion sports betting bill in Indiana’s state senate, and EPSN scribe David Purdum tweeted that the bill’s sponsor, Sen. Jon Ford, said Tuesday that his bill would not include an integrity fee. Hopefully, state politicians learn their lessons now, rather than learn more painful lessons later.