The Crown Resorts executives who got arrested last October for telling rich Chinese people that they could gamble in Australia, have been sentenced. Practically, they will be released in a few weeks. Lesson learned. Companies that hold their money in other countries best watch out. Beijing wants to keep money in the country and the Chinese people be damned if they want to move it out. Because what people actually want to do with their money doesn’t matter. What matters is how many currency units you can keep within a certain territorial border. Whoever has the most, wins the game. Or something like that.

The news brought Crown shares down about 1.4%, mostly because convicting executives sounds bad. But the verdict isn’t exactly surprising. I wouldn’t call the Chinese judicial branch independent. They do what they’re told. They were told to use these Crown executives as a warning to other non-Chinese companies. A not guilty verdict would have been embarrassing for the Chinese government.

The news brought Crown shares down about 1.4%, mostly because convicting executives sounds bad. But the verdict isn’t exactly surprising. I wouldn’t call the Chinese judicial branch independent. They do what they’re told. They were told to use these Crown executives as a warning to other non-Chinese companies. A not guilty verdict would have been embarrassing for the Chinese government.

But the practical effects of the verdict itself are nil. In These people are lucky they got off relatively easily. We can only hope nothing too terrible happened to them in prison. Crown isn’t going to be risking advertising in China again any time soon. They got the message.

Fortunately for Crown shareholders, the damage has already been done. The VIP segment is already down close to 50% across the board and yet Crown shares are almost at the same level they were at before the October arrests. At the time of the arrests, I said Crown was a buying opportunity and that has proven correct. The stock is up 14.6% since the day of the arrests. It’s a good time to take some profits now on up days, but not because Crown is in any particularly dangerous situation. It’s more of a China-centric issue that could temporarily hurt Crown, though not any more than other companies reliant on Chinese tourism.

The main danger is that Chinese mass market tourists could slow across the board and this could hurt the stock, just not as much as it will hurt other companies. In FY16, a third of the revenue generated by Australian resorts was from Chinese tourists. In 2015, Tourism Research Australia found that 1 in 4 Chinese tourists visited Crown while in Melbourne. How much will the pullback in advertising affect these numbers? I don’t think that much. It seems that what the Chinese government is most upset about is luring the VIP guys. These people get a lot of attention and going after them raises red flags. These are the same people that are being targeted in Macau domestically. It is unlikely that the Chinese government will make much of a fuss about mass market players going to Australia, so Chinese tourist numbers probably won’t decline any more than for other companies.

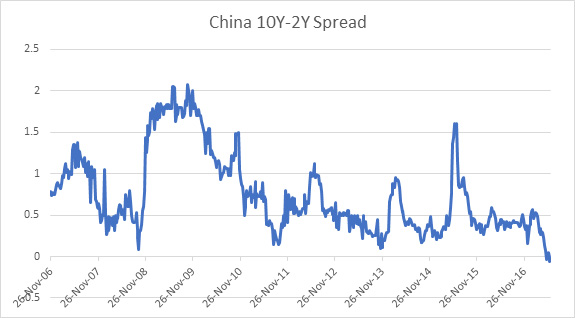

The problem is in China itself, not Crown. The monetary stress in China looks more acute now with the Chinese yield curve inverting. That means long term rates are lower than short term rates, which means banks risk losing money on loans. This slows the money supply, leading to downturns. Here’s a chart of the spread between 10-year and 2-year Chinese bonds.

It’s negative for the first time in at least 17 years if not more. (I couldn’t find Chinese bond yields from before 2006 but I assume the spread has been consistently positive since 2000.) Crown I believe is getting out at the right time. If this negative yield spread is predicting a Chinese downturn, then Crown is going to look good for getting out of Melco.

The exit from the Melco Crown joint venture has other benefits, too. Crown no longer has to exercise its REIT IPO option, so it can keep its real estate having raised enough money from the Melco exit to strengthen its balance sheet and lower its leverage. Net debt is down by 40% since the end of 2015 and total debt to equity is only 25%.

In the bigger picture, nothing happened to Crown as a company (the people involved here are certainly shaken though) that hasn’t happened to Macau itself and to other satellites. The ongoing anti-graft campaign is still smothering VIP in Macau, and whoever is left is going to look for alternatives outside the country. If Beijing is really intent on enforcing these advertising rules against all foreign companies using Crown as an example to strike fear, then Crown is not at any particular disadvantage compared to any of its competitors looking to bag a few Chinese whales. All that has happened here is that Crown got a head start on the collapse in VIP revenues. The fact that Crown has not only survived, but risen by close to 15% since then even with a steep 50% decline in the VIP segment is a good sign.

The bottom line is now is a good time to start scaling out on up days from companies that are reliant on Chinese tourism for revenue in genearl. Crown is one of these. The decline will have little to do with the arrests or the sentencing, but with Chinese internal issues. It’s a wait and see what happens with the yield curve and the Chinese economy, and Crown would be among the first companies to buy back once the next Chinese downturn relaxes.