Some online sports betting operators in the UK appear to have weathered the introduction of the new online gambling point of consumption tax (POCT) better than others, at least in terms of online traffic.

Some online sports betting operators in the UK appear to have weathered the introduction of the new online gambling point of consumption tax (POCT) better than others, at least in terms of online traffic.

London-based information technology firm SimilarWeb recently released its Sports Betting UK White Paper, which details how UK online operators fared last year in terms of site traffic, search terms, player engagement and desktop to mobile ratio.

SimilarWeb’s data shows that four brands – Bet365, Coral, Paddy Power and William Hill – increased their month-on-month online desktop traffic during the first half of 2015.

SimilarWeb suggested that these four operators were poaching traffic from operators that exited the UK market following the late-2014 introduction of the UK’s new licensing regime, and also from operators who chose to stay but reduced marketing expenses to offset the impact of the POCT.

Bet365 was the unquestioned traffic leader in 2015, with average visits rising 18% year-on-year to over 38m. Runner-up William Hill was up even more (25.6%) but well back at 23.3m average visits, while Skybet ranked third with 15.4m (+18.1%). Both Ladbrokes and Paddy Power recorded healthy gains, rising 38.2% and 50.6% respectively, but last year’s biggest traffic gain came from 10bet, which rose 825% to 2.1m visits.

Notable traffic losers included Betfred (-39%), Betvictor (-41%), GVC’s Sportingbet (-51%) and Bwin (-54%), although Ladbrokes’ exchange betting site Betdaq reported the biggest loss, falling 56.3% to average just 73k visits.

Bet365 was also the top betting brand in gambling keyword search terms, coming second only to the National Lottery. Skybet ranked fourth, William Hill came sixth and ninth-place finisher Paddy Power rounded out the betting brands in the top 10.

In terms of search category share, “lottery & other” was well out in front at 64%, followed by sports betting (36%), casino (23%), poker (8%) and bingo (2%).

Mobile’s share of sports betting web traffic was 50% in 2015, up from 35% in 2014. Mobile traffic improved 44% year-on-year while desktop traffic fell 23%.

In terms of desktop/mobile split, Betfair, Skybet, Coral and Paddy Power were the only sites whose mobile traffic outpaced the desktop, with Betfair’s mobile margin being the most pronounced. Operators whose mobile traffic significantly lagged the desktop were 10bet, Playtech’s TitanBet and Bwin.

Betfair saw its UK traffic share significantly reduced in 2015 but its remaining users are a loyal bunch, ranking the site best in average visit duration (16:39), average pages per visit (12.1) and bounce rate (20.1%). Bet365 scored second in visit duration (11:35) and third in both page visits (7.5) and bounce rate (43%).

Bwin.com ranked second in page visits (8.2) and bounce rate (42.9%), but Bwin visitors spend an average of just 6:43 on the site, below William Hill (8:49) and Coral (7:24). So are Bwin users more efficient or do they give up quicker after viewing multiple options and not seeing anything they like?

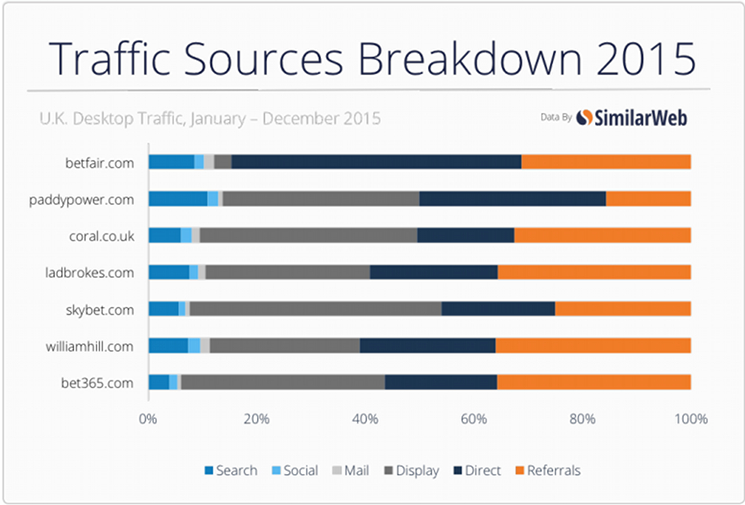

Below is a chart representing the sources of traffic for some of the major sites. Plenty more where this came from available at the SimilarWeb site.