So it’s eventually happened. All the talking is over and the worst kept secret in some time has come true as Facebook embarked on the most lucrative initial public offering (IPO) of all time. Everyone’s favorite hooded CEO and star of his own film, Facebook CEO Mark Zuckerberg, has overseen an IPO with shares at an offer price of $38 giving the company a valuation of $104.2 billion. The big question on everyone’s lips is can they stay at that level or will they succumb to a gaming industry public company-esque fall in share price for the next six months.

So it’s eventually happened. All the talking is over and the worst kept secret in some time has come true as Facebook embarked on the most lucrative initial public offering (IPO) of all time. Everyone’s favorite hooded CEO and star of his own film, Facebook CEO Mark Zuckerberg, has overseen an IPO with shares at an offer price of $38 giving the company a valuation of $104.2 billion. The big question on everyone’s lips is can they stay at that level or will they succumb to a gaming industry public company-esque fall in share price for the next six months.

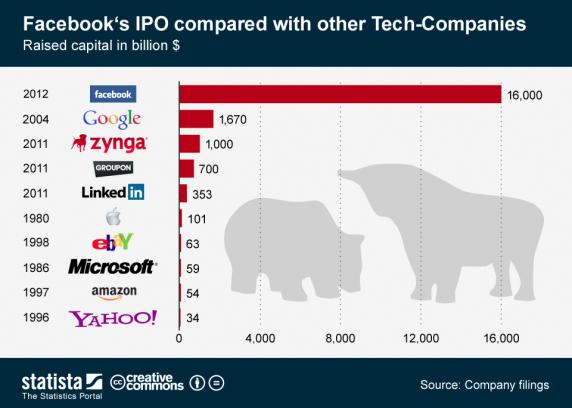

All signs point towards the company doing fine. The IPO that precedes the flotation has already earned them $16 billion and no other big tech company even came close when they had their respective IPOs. Statista’s chart’s of the day, which you can find at the foot of this article, show that the second most lucrative IPO, Google in 2004, raised little over a 16th of Facebook’s IPO capital ($1.67 billion). That alone will make the big wigs at Facebook mightily optimistic and the market capitalization gives more reason for confidence.

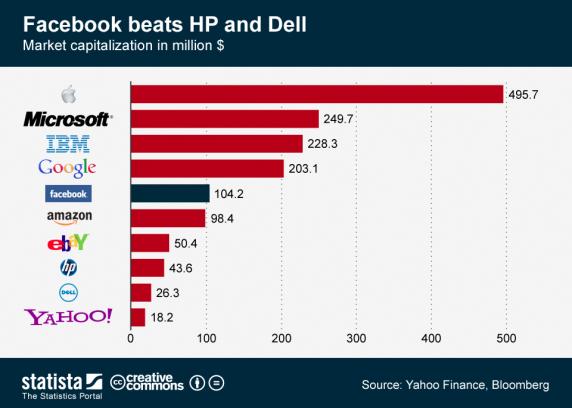

The valuation of $104.2 billion puts them behind just Apple ($495.7bn), Microsoft ($239.7bn), IBM ($228.3bn) and Google ($203.1bn). It’s perhaps more significant that they’re ahead of the likes of Amazon, eBay, HP, Dell and Yahoo and you get the impression there value will be one that won’t be staying in fifth place for long.

Almost all the other tech giants, a group that includes Apple, Microsoft, Amazon and Google, have seen huge spikes in the price of their stock before it levels off and is steady. It’s another fact that points to the company valuation hitting even higher heights than it’s at now.

The market value and money raised from the IPO will be of comfort to a gaming industry that is attempting to grab social gaming by its horns and ride it into the sunset. Facebook will be a huge part of this and at the moment it looks as though the world’s biggest social network will be here for some time yet.