Although Wynn Resorts’ tentative deal with PokerStars got torpedoed by the events of Black Friday, Steve Wynn’s luck has been pretty good of late. Just last week, Wynn Resorts’ first quarterly report of 2011 revealed a company awash in Macau money. Now Steve’s ‘wynning’ ways have followed him to Los Angeles, where a Superior Court has tossed out the countersuit filed against him by Joe ‘meatstick’ Francis.

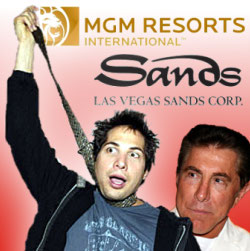

Although Wynn Resorts’ tentative deal with PokerStars got torpedoed by the events of Black Friday, Steve Wynn’s luck has been pretty good of late. Just last week, Wynn Resorts’ first quarterly report of 2011 revealed a company awash in Macau money. Now Steve’s ‘wynning’ ways have followed him to Los Angeles, where a Superior Court has tossed out the countersuit filed against him by Joe ‘meatstick’ Francis.

In case you were unaware, the Girls Gone Wild founder had run up a $2.5m gambling debt at Wynn’s casinos, of which he repaid only $500k. Worse, Francis told gossip site TMZ that Wynn had threatened to kill him and bury him in the Nevada desert (not necessarily in that order). That prompted Wynn to file a defamation suit, prompting Francis’ short-lived countersuit, in which he claimed that Wynn had unfairly taken away Francis’ 30% high-roller discount (gosh, we wonder why). Wynn’s defamation suit is scheduled to go to trial Sept. 14.

According to an Associated Press tally, Las Vegas Sands Corp. paid CEO Sheldon Adelson $11.4m in 2010 – double his 2009 take. Most of that increase came from a $5.7m performance-based bonus (his first since 2007). Adelson was paid a base salary of $1m, $1.8m in options and $2.9m in perks. What’s more, Adelson and various family members hold over half of all LVS shares.

Sticking with LVS, the Las Vegas Review-Journal reports that Sheldon’s crew has finally signed up with the Nevada Resort Association, joining MGM Resorts, Caesars Entertainment, Boyd Gaming, Station Casinos and others. Just a theory, but does LVS’ sudden ‘we are family’ act signal the future possibility of a coordinated push to bring online poker to the land-based casino giants’ balance sheets? Or do they just have really good donuts at their monthly meetings?

Speaking of MGM Resorts, financial regulators want to see more info before they approve MGM China’s planned initial public offering on the Hong Kong Stock Exchange. According to Hong Kong newspaper Apple Daily, the Listing Committee of the Hong Kong Exchanges & Clearing Ltd. “doubts who will be the controlling shareholder, and concerns about possible shareholder disputes in the future.” The IPO filing lists MGM as holding a 51% stake, Pansy Ho getting 29%, and the remaining 20% to be sold to the public. As analyst David Katz observed, “The proposed structure was intended for MGM to retain majority ownership of its most valuable asset, while receiving a $300 million cash infusion into its US parent.” Too bad regulators seem to be saying not Ho fast.