The VIP market continues to be the backbone of Macau’s casino revenues but for Wynn Macau, its the mass market earnings that have been largely responsible for its robust earnings in the first three months of the year. The Hong Kong listed company of Wynn Resorts Ltd. has posted a pretty impressive first quarter profit, improving its numbers by 14 percent on the back of higher mass-market earnings.

The VIP market continues to be the backbone of Macau’s casino revenues but for Wynn Macau, its the mass market earnings that have been largely responsible for its robust earnings in the first three months of the year. The Hong Kong listed company of Wynn Resorts Ltd. has posted a pretty impressive first quarter profit, improving its numbers by 14 percent on the back of higher mass-market earnings.

According to a filing by Wynn Resorts Ltd., Wynn Macau’s property earnings before interest, taxes, depreciation and amortization (EBITDA) shot up to $330.7 million for the three months of 2013, a figure thats’ noticeably higher than the $316 million median estimate of multiple analysts. Mass-market earnings accounted for $243.1 million of those earnings, a 14 percent improvement from its previous numbers. Likewise, the casino’s VIP win also improved, albeit at a more conservative 3.14 percent, still higher than Wynn Macau’s forecast of 2.7 percent and higher than the company’s performance last year when it saw growth of 2.59 percent.

Overall, Wynn Macau’s revenue improved by 4.4 percent to $992.1 million, posting impressive numbers despite having only one casino in Macau and facing rising competition from a lot of its competitors.

All the activity has resulted in solid improvements, even for Wynn Resorts’ first quarter net earnings, which improved by 44 percent to $203 million, an improvement from its numbers a year ago when it earned $140.6 million.

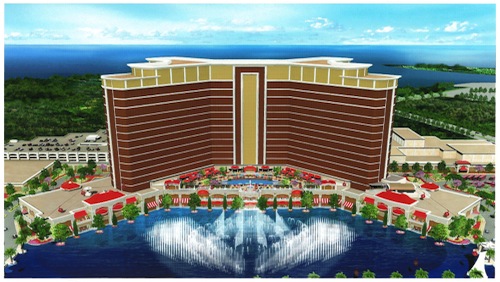

Meanwhile, the company’s second casino, which will be located in Cotai and will reportedly cost $3.5 billion to $4 billion to build, has already begun its foundation work with construction expected to commence in the coming months in anticipation of its 2016 opening.

Wynn Macau is banking heavily on this new casino to help it gain some ground against its competitors in Macau. Currently, the company sits fifth among the six operators doing business in the gambling town with an 11 percent market share. That number is just slightly higher than MGM China Holdings Ltd’s nine percent market share and a long ways away from top share holder SJM Holdings, which accounts for 27 percent of Macau’s market share pie.