New Jersey’s online gambling and sports betting markets closed out 2020 in style, setting all-time revenue records.

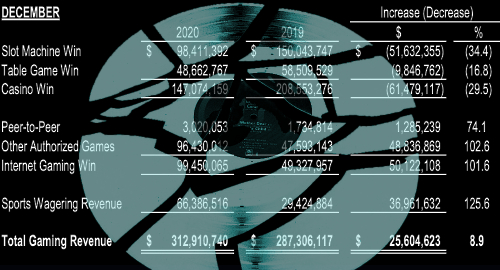

Figures released Wednesday by the New Jersey Division of Gaming Enforcement show the state’s licensed online casino and poker operators generated combined revenue of $99.45m in December, more than doubling its December 2019 total and $7.65m better than November 2020’s result.

December’s online casino operators drove the record-setting performance with revenue up 102.6% to $96.43m while online poker was up nearly three-quarters year-on-year to just over $3m, a 25% improvement from November.

For the year-to-date, total iGaming revenue came within $30m of the ONE BILLION DOLLAR mark, up 101% from 2019. Online casino did the heavy lifting, rising 101.7% to $931.5m while poker improved 85.3% to $38.8m.

As always, the Golden Nugget’s online casino led the pack with $29.4m in December for a FY20 total of $318.8m. To put that in perspective, the Nugget’s land-based gaming revenue totaled only $95m (-52.2%) last year, although Atlantic City’s casinos spent most of 2020 either shut completely or operating at reduced capacity due to COVID-19.

The Borgata’s online offering – which includes the Borgata’s own brands, BetMGM, PartyPoker and PalaCasino – came within a whisker of dethroning the Nugget with revenue of $27.15m in December, of which $1m came via poker. The Borg’s FY20 iGaming tally gained nearly 168% to $208.2m.

Resorts Digital Gaming – home of DraftKings, Flutter Entertainment’s FoxBet brand and Resorts’ in-house brand – narrowly beat the Borgata on the FY20 chart with $208.4m, although its December total managed only third-place with $21m.

As always, Caesars Interactive Entertainment won December’s poker crown with $1.17m, but its total December iGaming revenue was a mere $8.9m, bringing its FY20 total to a (comparatively speaking) disappointing $94.8m.

The Tropicana’s casino-only site ranked fourth with $6m in December for a FY20 total of $70.1m. Hard Rock AC earned $5.8m in December for a FY20 total of $59.6m, while Ocean Casino Resort ranked last with $1.1m in December and $10.3m for the year.

SPORTS BETTING

As for New Jersey’s licensed sportsbooks, December’s betting handle came within $3.7m of the ONE BILLION DOLLAR mark, of which $929.3m was wagered online. December’s betting revenue was a record $66.4m, 125.6% better than December 2019.

Total betting handle for the year came in just over $6b, up from $4.6b in 2019. Total online handle in FY20 was $5.53b, representing 92% of overall wagering. Last year’s betting revenue was up nearly one-third to $398.5m, bringing 2020’s combined betting/iGaming contribution to nearly $1.4b, only around $100m below what AC’s casinos earned from their slots and table games.

The FanDuel/Meadowlands tandem crushed December’s revenue chart with nearly $33.2m, half the market total. DraftKings/Resorts Digital were a distant second with $15.4m, while the BetMGM/Borgata pairing was well back in third with $7.5m.

FanDuel/Meadowlands claimed more than half FY20’s betting revenue total with $206.5m, with DraftKings/Resorts again a distant second with just under $101m and BetMGM an even more distant third with $31.5m.

New Jersey’s bounty should serve as a lesson for all US states that are still mulling whether to authorize online betting or iGaming. It’s difficult to think how much worse AC’s situation might have been had the state not had a mature, comprehensive digital alternative waiting in the wings as the pandemic shut land-based gaming.