We may finally have some light at the end of this COVID tunnel. Even so, with stocks as ridiculously high they are it’s impossible to know what happens now. The S&P 500 started off strong yesterday, but finished below its pre-vaccine announcement news. The bubbly Nasdaq actually lost 2% as stay-at-home COVID stocks tanked. Everybody is totally confused. Finding a good investment as opposed to a speculation on prevailing Wall Street mood swings is still a daunting task.

We may finally have some light at the end of this COVID tunnel. Even so, with stocks as ridiculously high they are it’s impossible to know what happens now. The S&P 500 started off strong yesterday, but finished below its pre-vaccine announcement news. The bubbly Nasdaq actually lost 2% as stay-at-home COVID stocks tanked. Everybody is totally confused. Finding a good investment as opposed to a speculation on prevailing Wall Street mood swings is still a daunting task.

In the meantime, real business conditions continue to deteriorate in Europe as the lockdowns have returned. Today we’ll go through one of the newer European players, Aspire Global, one of the few bona fide investments left in the European gaming sector. It’s not riskless, and there are considerable dangers attached to it. But it does have all the characteristics of an ambitious, sprightly, yet conservatively managed company with new and exciting products that just needs a bit to go its way in order for it to reach a new and higher tier. A successful COVID vaccine would certainly help in that direction.

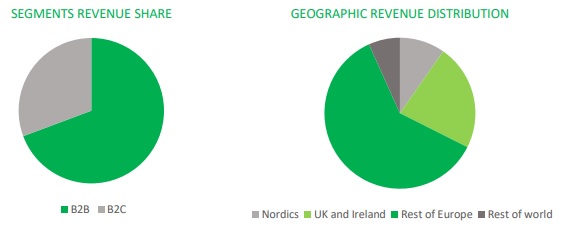

In many ways, Aspire looks a lot like 888, both in its fiscal management and business style. The two companies are already working together actually, through Aspire’s Pariplay casino gaming subsidiary. Aspire is small and nimble, with products that stand out, a 75% focus on B2B over B2C and small, early acquisitions that complement its pipeline and ambitions. Also like 888, Aspire has no net debt, and from what I can see, it is not in the business of humongous moves that grab headlines but put its long term future in doubt. It only joined public markets in 2017, and since then its stock has been more or less stable and the company consistently profitable. The stock tanked during the March panic like everything else, but really not by much relative to its peers.

Where Aspire currently is in its development as well as its inherent business model do help mute the effect of lockdowns so you can’t really see them in its top and bottom lines. Total revenues for the first 9 months of 2020 were 18% higher than for 2019. Net income was down 20%, which is to be expected for a company looking for growth opportunities. The key is, it’s been clearly profitable throughout this tumultuous and crazy year, and that gives Aspire some breathing room to get through the challenges of 2021, which in my view could be quite extreme. Many companies won’t survive 2021 in my opinion, at least not in their present forms. But Aspire has a good shot at making it through if it remains careful. If it does make it through, the opportunities on the other side will be huge.

The main risk with Aspire you can see below, right side.

About 70% of its current revenue comes from Europe outside the UK. Nobody knows what is going to happen to Europe in 2021. We still do not know what the impact of Brexit will be on the extremely sickly European banking system, whether the United Kingdom will finally cut a deal with Brussels or not, whether we will have a currency crisis in the wake of more lockdowns, or how long these lockdowns will even last. Europe is just one big question mark and to assume that 2021 will be basically OK is wishful thinking.

That said, the best approach with Aspire would be to buy slowly, and only over the course of a year or so. If we have another market panic like we have in March, the stock is definitely going to tank, so you don’t want to go all in here in case we do have one and you end up panicking out. This is a stock for a slow burn position buildup on the assumption that the company will make it through the turmoil of the coming year and then proceed to grow from there.

Another benefit of owning Aspire is that much of its growth is already baked in, and it’s not clear if its stock price reflects this yet. For example, sportsbook only makes up 11.2% of its revenues currently. But the recent acquisition of the B2B sports platform BtoBet (without going into net debt in order to acquire it) has yet to be accretive. BtoBet already has Flutter’s Betfair as a client – only in a small operation in Colombia, but that still speaks to the quality of the service and the willingness of big conglomerates like Flutter to sign up and take a chance. GVC, the other giant in the room, is also a client.

By July 2021, Aspire expects to be integrated into the German market, with a new CRM system to boot, so if the disintegrating project that is the European Union can manage stay together for another year, we could see some significant upside in 2021. If not, the regulatory inroads already made in Germany will not simply disappear, so effort will not have been wasted.

Aspire’s focus on B2B is appropriate for the times, because if its products make other businesses more efficient on a revenue-sharing model, there is no reason for clients to abandon ship if they encounter some sort of crisis ahead. Aspire Core, BtoBet, and Pariplay all work on a revenue sharing model. Revenues may go down if things turn for the worse, but the position Aspire is in strategically insulates it to a good degree.

A small speculative position in this stock can be built up slowly over the next several months on the dips, and if there is some sort of panic in Europe in 2021 that brings everything frightfully down, keep in mind that Aspire is still strong enough and small enough to weather the storm.