Macau casino operator Galaxy Entertainment Group (GEG) saw its Q1 earnings plunge 93% and things would have been even worse had the operator not ‘played lucky’ with its customers.

Macau casino operator Galaxy Entertainment Group (GEG) saw its Q1 earnings plunge 93% and things would have been even worse had the operator not ‘played lucky’ with its customers.

Figures released Wednesday by the Hong Kong-listed GEG shows the company generated revenue of HK$5.1b (US$658m) in the three months ending March 31, down 61% from the same period last year and down the same rate from Q4 2019.

GEG’s adjusted earnings fared much worse, falling 93% year-on-year to just HK$283m, and would have fallen 95% had its casinos not ‘played lucky’ at its two major Macau properties, Galaxy Macau and StarWorld Macau.

GEG’s Q1 gaming revenue (after commissions and incentives) was down 63.5% to HK$4b as spending fell across the board due to the Macau casino market’s 15-day shutdown in February, the limited gaming options upon reopening and the COVID-19 quarantine restrictions that slowed Macau’s visitor traffic to a crawl.

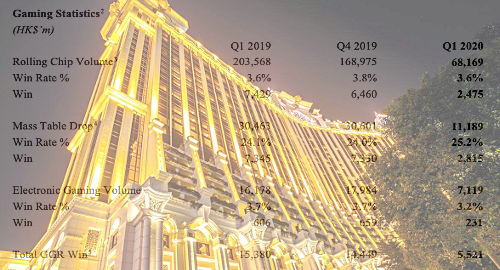

VIP gambling turnover fell 66.5% and revenue fell a similar ratio to just under HK$2.5b. The figure would have been even worse had VIP gambling win rate not hit 3.6%, the same rate as in Q1 2019 but well above the traditional range of 2.7-3.0%.

Mass gaming table drop fell 63% but win improved 1.1 points to 25.2%, resulting in revenue of just over HK$2.8b, down 61.6% year-on-year but enough to top the VIP contribution. Slots volume fell a comparatively modest 56% but win fell, pushing slots revenue down 62% to HK$231m.

Hotel occupancy at Galaxy Macau was a mere 38%, compared to “virtually 100%” in the same period last year. StarWorld’s occupancy wasn’t much better at 42% while the much smaller Broadway Macau venue dipped as low as 34%.

GEG chairman Lui Che Woo said he was proud of his company’s staff for their devotion to duty during this “difficult period.” Lui said GEG remained “well capitalized” but the company was nonetheless “doing our best to adjust our operations to the current business environment and effectively control costs.’

Lui said all staff, including management, had made “voluntary contributions” to the cost-cutting efforts, and GEG was trying to “spread the impact of COVID-19 fairly across all team members as we prefer not to engage in redundancies.”

While the company said COVID-19 uncertainty made performance forecasts impossible, Lui noted that GEG remains committed to pursuing a Japanese integrated resort license, a pursuit that got a boost on Tuesday from Las Vegas Sands’ decision to withdraw from the race.