The entire concept of a “bull market in stocks” makes little sense. Sound crazy? These days, certainly, because we’re always hearing about a perpetual bull market in stocks. Valuations increasingly disconnected from economic reality, asset bubbles in one class or another, armies of speculators moving like zombie hoards descending on the next fad and blowing it up to infinity and beyond, Buzz Lightyear-like.

Why is the whole concept of a bull market generally, nonsense? Because if the value of everything is going up simultaneously, then nothing is going up. If everyone is a superhero, nobody is. If, in an imaginary economy, absolutely everything costs, say, $5, (labor, land, capital whatever) and then the next day everything costs $10, then what’s changed? The answer is absolutely nothing.

The only thing that matters is relative valuations between asset classes. Let’s divide them into three of the most basic ones. Equities (stocks), bonds (debt), and commodities (consumer goods). If all three are going up in tandem, then there is no “bull market” in anything. If commodities are going up faster than stocks and bonds, you have inflation, or even hyperinflation. Ask anyone in Venezuela whether they care that their stock market is doing great, nominally. They don’t. They’re looking for their next glop of gruel or morsel of moldy bread to survive the day.

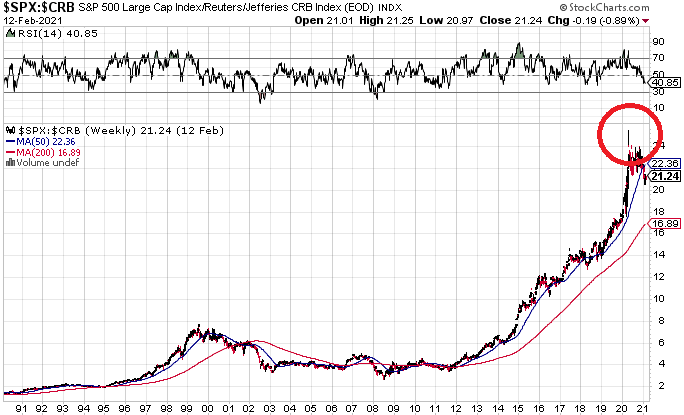

But if stocks and bonds are rising and consumer goods are static to falling, you have a bull market in financial assets. This is where we are now. And boy are we really hard and deep into it now. Below is the ratio of the S&P 500 to the CRB Commodities Index.

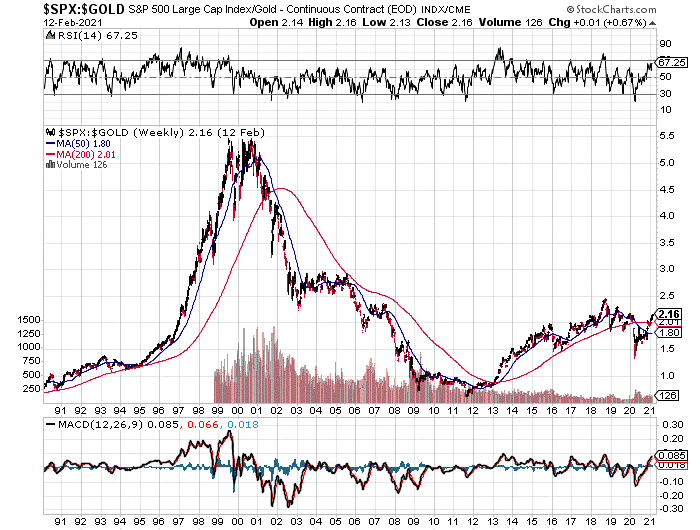

And I’ve got news for everyone. This bull market in stocks relative to consumer goods in dollar terms is already over. It ended almost a year ago. On April 20, 2020 to be exact. Red circle blowoff top above. That was when oil crashed to negative $35 a barrel and we all lived in an alternative financial freakhouse universe. But I have more news than that. This entire “bull market” in stocks has been one gigantic illusion from the very beginning. Stocks aren’t going up. They haven’t gone up for 21 years. Money is going down. Here is the graph of stocks relative to the prime monetary commodity, gold, over the same timeframe above.

We can see here that from 1990 to 2000, we had a real bull market in stocks. Equities rocketed in gold terms and in terms of consumer goods generally. Everyone felt richer. Portfolios up, expenses down. But since that time, money has been dying at an accelerated pace and the standard of living has fallen.

The bull market in stocks over the last 21 years has been an illusion, a tiny echo of the bull that ended at the turn of the century. We have spent the last 21 years trying to reinflate it, but gold has exposed the lie. We are now at the point where the illusion is about to collapse completely. In my view, we have only a few months left until it all hits the fan.

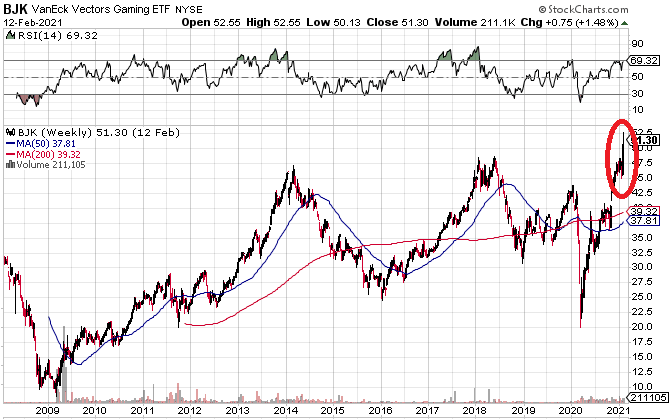

Until then, the bubbles will keep coming in staccato frenetic fashion, moving from one asset class to another faster and faster, until we all get so dizzy we can’t follow it anymore. Last week I speculated that maybe the next target for the zombie hoard will be in penny gaming stocks. I was close. It’s in Macau stocks. It may already have started two weeks ago. The frenzy has started over news about China opening up again. I mean, just look at this crazy chart of the Macau proxy ETF:

That last surge higher is just since February 1. We could be at the beginning of a crazy but brief ride higher in Macau stocks right now. New all time highs again, and Macau isn’t even fully open yet. The latest full month statistics for December show a 78.6% drop in visitors year over year. And yet we’re at new all time highs in these stocks already. It’s just completely crazy. I can understand the Macau opening up again trade, but to argue that this factor is being priced in at these levels, at new all time highs? As if none of this full year shutdown hurt any of the casinos fundamentally at all? That’s just totally bonkers crazy. It’s a reflection of the value of the currency these stocks are priced in, not the stocks themselves.

What’s happening is that the zombie hoard of bubble chasers is reading the headlines regarding China starting to open up again, and they’re slamming buy orders and call options like they’ve been doing with tech stocks and Gamestop and BTC and all the other fads. We just got news out of Bloomberg that China’s Imax had a face-ripping rally due to exploding ticket sales. China is, indeed opening up, and the zombie hoard of speculators is now going to spray their money hoses at anything Chinese. Macau might be at the center of it.

How high can this Macau bubble go, if that’s what we just saw start two weeks ago? The truth is, it doesn’t matter. If you get into it, you’ll get hooked and keep levering yourself up, counting your paper gains, unable to separate from them until you get caught in a vortex. At some point, my view this year, it’s all going to come crashing down when all the damage from 2020 is finally revealed all over the world. You can’t paper it over forever. The damage to Macau casinos doesn’t just go away. It festers in the form of more and more debt, and a damaged consumer base that can no longer patronize casinos in the way it once could. Festering wounds need the paper bandage removed and they need to be operated on. That is painful. And it’s coming.

When we think of the word “bubble”, what are we really talking about? A bubble is something that looks, from the outside, to be really big and stable. The shape of it, a sphere, is the most stable shape in the universe. It’s why planets, stars, moons, and possibly even the spacetime continuum itself, spontaneously shape themselves into spheres. The force of gravity equalizes at every point on the sphere, forming equilibrium. Nature always seeks equilibrium. And so bubbles take on the illusion of stability, but unlike a real sphere, there’s nothing inside them. When they pop, they are gone almost instantly. This one is about to pop. Macau appears to be the next victim sucked up by the bubble. Macau will survive and rebuild. The question is, in what form? I wouldn’t take a bet the depended on me getting the answer to that question right.