Sweden’s gambling participation rate has fallen since the launch of the country’s regulated online gambling market in January.

Sweden’s gambling participation rate has fallen since the launch of the country’s regulated online gambling market in January.

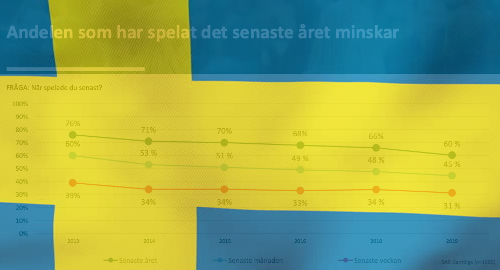

On Tuesday, Sweden’s Spelinspektionen gambling regulatory body released its latest survey of the habits of the nation’s gamblers. Of the 1,600 Swedes surveyed, 60% reported gambling during the past 12 months, down six points from last year’s survey and down 16 points from 2013, the first year the survey was conducted.

This year’s decline was the largest since 2014, but the numbers have trended downward every single year. Men continue to participate at a higher rate (45%) than women (31%) but each figure was three points below the 2018 result.

Of those who didn’t gamble this year, the most commonly cited reason was a history of never winning, with ‘low confidence in the current gaming market’ and boredom tying for second place. The ‘too much advertising’ score doubled year-on-year to 8%, lending weight to the government’s occasional musings regarding an Italy-style gambling advertising ban.

In terms of frequency of play, Swedes reported record-high numbers in terms of weekly activity (33%, +3 points from 2018) and monthly activity (58%, +3).

However, Sweden’s liberalized online market doesn’t appear to have boosted overall online participation, with online lotteries, number games and horseracing wagers increasing while sports betting, casino and poker products posted mild declines.

State-run Svenska Spel remains the dominant online operator, with 63% of Sweden’s online gamblers having played with the site this year, up three points year-on-year and up 11 points from 2017. The AB Trav and Galopp (ATG) horseracing monopoly held on to second-place with 17% (+2) while Bet365 (4%) outpaced Kindred Group’s Unibet brand (3%) as the top private online operator.

As in 2018, a host of other private operators notched 1% scores, including William Hill’s MRG, Betsson and its Betsafe offshoot, while the low-margin sportsbook Pinnacle made its first appearance on this list. The Stars Group’s PokerStars brand failed to qualify for this 1% honor in 2019, a fate shared by LeoVegas, Cherry AB and Kindred’s Maria Casino brand.

This year’s survey introduced a new question that found 3% of respondents had knowingly gambled at a site not holding a Swedish license, while another 17% claimed not to know if they’d broken the rules. The most popular reasons for patronizing internationally licensed sites were having pre-liberalization legacy accounts and the pursuit of better odds.

The number of Swedes who believe gambling operators take responsibility for gambling dependency fell to 37%, the fifth straight year this figure has declined. Over half of Swedes professed ignorance of the Spelpaus self-exclusion registry, but more online gamblers said they’d opted to impose mandatory spending and time limits on their activity in 2019.