Macau casino operator SJM Holdings saw its profits rise in the first half of 2019 despite falling revenue, particularly in its VIP gambling segment.

Macau casino operator SJM Holdings saw its profits rise in the first half of 2019 despite falling revenue, particularly in its VIP gambling segment.

Figures released Tuesday by the Hong Kong-listed SJM showed the company’s total revenue and net gaming revenue each falling 0.7% year-on-year to HK$17.1b (US$2.2b) and HK$16.2b, respectively, in the six months ending June 30. Meanwhile, adjusted earnings rose 6% to HK$2.1b and profit gained 12% to HK$1.68b ($214.7m).

The results accelerate a trend from SJM’s Q1 report, which saw revenue inch up 0.8% while profit jumped 16.5%. The H1 profit rise was in part due to lower special gaming taxes, levies and premium, but also due to SJM’s increasing reliance on the more profitable mass market gaming segment (and reducing commmissions to junket operators by nearly HK$1.5b).

SJM’s VIP gambling turnover was down by nearly one-third, while its VIP revenue slipped one-quarter to HK$7.45b, despite a modest boost to its VIP win rate. Mass market gaming revenue rose 8% to HK$12.4b, pushing the mass share of SJM’s overall gaming revenue up 8.5 points to 60.7%. Slots revenue was basically flat at HK$575m.

SJM’s share of Macau’s overall VIP market fell 1.5 points to 10.7% in H1, while its mass market share slipped two points to 18.2%.

SJM’s share of the overall Macau market fell to 14.1% in H1, down a full point year-on-year and yet another new low for Macau’s original casino operato. It’s worth remembering that SJM controlled more than 23% of the market as little as five years ago, a sign of how far the company has lagged behind its competitors in ‘wowing’ Macau’s visitors.

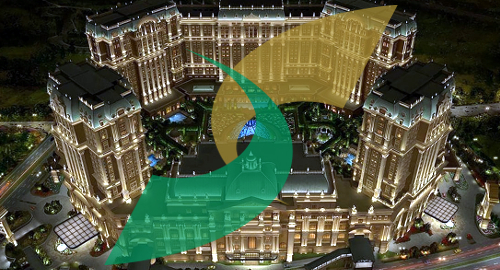

Speaking of, SJM has once again delayed the opening of Grand Lisboa Palace, the company’s first major integrated resort in Macau’s Cotai region. The company now says that, while it will finish construction of the property by the end of this year, the public won’t be let inside until sometime next year. SJM remains the only Macau casino concessionaire without a Cotai presence.