The stock market is at record highs, unemployment is at record lows, we are now officially in the longest uninterrupted economic expansion in the history of the United States, and the Nevada gambling market continues to be in the longest recession in its history.

Economic statistics don’t mean much of anything on an individual level or sector level. It’s mostly just a statistic that investors use to guess everyone else’s next moves, and politicians use them to pat themselves on the back and justify taking a bigger share of it all. If you’re making less money this year, you’re in a personal recession regardless of what the aggregates say. If you’re making more but the stuff you buy is getting more expensive even faster, you’re still in recession and how the statistics are doing is irrelevant. This is the case for the Nevada gambling industry, too. For 11 years now, Nevada has yet to break to new highs in gambling revenue, even as the consumer price index (CPI) has risen by 20% since then.

Economic statistics don’t mean much of anything on an individual level or sector level. It’s mostly just a statistic that investors use to guess everyone else’s next moves, and politicians use them to pat themselves on the back and justify taking a bigger share of it all. If you’re making less money this year, you’re in a personal recession regardless of what the aggregates say. If you’re making more but the stuff you buy is getting more expensive even faster, you’re still in recession and how the statistics are doing is irrelevant. This is the case for the Nevada gambling industry, too. For 11 years now, Nevada has yet to break to new highs in gambling revenue, even as the consumer price index (CPI) has risen by 20% since then.

Peak Nevada occurred way back in 2007, with $12,480,790,793 in statewide gambling revenue. Over the next three years, gross gaming revenue in Nevada fell by 20.6% overall for the biggest sustained decline since statistics were recorded. Over the next 8 years, revenue has clawed back 17%. At this rate, it’ll be another 4 years until we hit the 2007 highs. My bet is we’re not going to make it back there before the next decline takes hold, and even if we do, adjusted for price inflation we’d have to clip off 20% from 2007 dollars to 2018 dollars. (CPI at the beginning of 2008 was 212.174, compared to 255.155 now). By the time we reach the nominal high in 4 years at the current rate, we’ll probably have to clip off another 10% at least. Like a hamster on a wheel running after a moving target (is that a thing?), full recovery for the Nevada gambling industry looks to be out of reach.

In comparison to any other recession since the 1970’s, the last one was by far the worst for Nevada. It’s not even close. In 2001 after the tech bubble burst, Nevada gambling revenue fell 4.3% peak to trough, but was back to new highs by 2004. Following the recession of 1990-1991, we didn’t even see a fall in annual revenue. We saw sluggish growth at only 1.3% in 1992 compared to the year before of 11.3%. But still the industry kept growing. If we want to move back even farther we have to move to Clark County Statistics, because the Center for Gaming Research only goes back to 1984. The double dip inflationary recession of 1980-1982 was rough, with Clark Country gambling revenue climbing only 16.7% in three years while price inflation exploded 25.64%. Clark County didn’t overcome the slump adjusted for inflation until 1985 despite an 18.9% rise in visitors over those 6 years.

It’s not that people have stopped coming to Las Vegas. By 2012, Clark County was seeing new highs in annual visitation. They’re just not spending as much time or money gambling. Also, the rate at which people are coming has slowed to a tortoise crawl. The percentage increase in visitation over the last 11 years has been less than the increase from the 4 year period between 2003 and 2007. Since 2016 though, total visitor volume has dropped, and we’ve basically been static since 2014. The fall from 2016 to 2017 in total visitation was eclipsed by the dramatic increase in convention visitation, but now even that number is falling. Total Clark County gaming revenue is still 5.7% below the 2007 peak despite the U.S. money supply more than doubling since then.

There are many ways to explain this, some bullish and some bearish. Factors both good and bad are responsible in different degrees. It’s just a question of which is more dominant. On the bullish side, we have the increase in regional gaming popularity and casinos in Asia, stealing some of the market from Las Vegas. The Las Vegas monopoly on sports betting in the U.S. is now off the table, so this trend could continue. We can see this in the regional versus Las Vegas table games drop statistics out of MGM. Table games drop is down 7% in Las Vegas, but up 9.75% in the regional market (page 28), so this is definitely a factor. On the bearish side and more broad strokes, we have this chart from Reuters that just came out today.

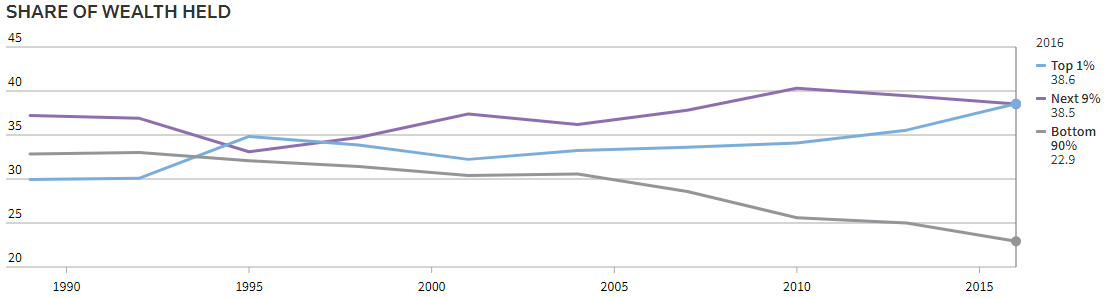

It is no surprise to anyone who understands the damages of currency devaluation. Since 2007, the vast majority of Americans have gotten poorer from a pure individual balance sheet perspective, while the wealthiest 1% have gotten richer. This is not a new trend. It has been in place since 1971. From 1940 to 1970, income growth in the U.S. for the bottom 90% was over 200% inflation adjusted, and the dollar was still on a gold standard, barely. Since 1971 when the dollar’s last link to gold was severed, income growth for the wealthiest 1% has skyrocketed about 220%, while the bottom 90% has gone nowhere. The 1990’s saw a brief blip up in income growth for the bottom 90%, but that has since evaporated.

Paper money always benefits the politically connected and those who can afford to invest most of their income in stocks and real estate. That’s where the newly printed money goes first, appreciating those assets and growing the wealth of the 1% way faster than the bottom 90%. Unlike Macau, there is no widespread phenomenon or culture of VIP gambling in the U.S.. So as the bottom 90% loses purchasing power, they gamble less and less. The answer to this is not to tax the 1%, give a nickel to the 90% and spend the rest bombing some third world country. The answer is to stop ruining the money of the 90% by keeping real interest rates at 0%, where they still are today and we’re about to start another easing cycle.

From an investment perspective, the question is will regional gaming grow fast enough to give stocks like MGM one more burst higher? At this point chances look good. The U.S. market doesn’t look as risky as it did earlier this summer since we are already at a new dollar supply high since June 10, one month earlier than last year and 2 months earlier than usual. If rates are indeed headed lower once again, we could see a very big year for monetary growth. As long as it doesn’t show up in the CPI too obviously and Trump doesn’t start a major war that brings oil to $200 a barrel, U.S. stocks should start climbing once again, meaning it’s alright to nibble on MGM here at these levels.