MGM is in overall good shape with healthy finances, but it may be setting the bar too high for itself. It’s a company in flux, and will likely look very different in the 2020s than the 2010s. Looking to divest itself of Nevada real estate and concentrating on Macau, regional casinos, sportsbook and possibly Japan means that the trading patterns and price action that have accompanied it since the financial crisis are unlikely to hold up over the next decade. We could see a more volatile stock price going forward. MGM looks like it is trying to become a growth stock. Resolve will be tested as the company changes form.

The Nevada real estate crash of 2008 caught MGM by complete surprise, and its moves and plans have signaled that it won’t be caught this time. From 2003 to 2007 MGM was high on the real estate boom, but paid the price. Now on its list of priorities is to divest even further from the real estate market after the MGP spinoff, and execute what it calls an “asset-light” strategy. It’s looking specifically to dilute its interest in properties at MGM Springfield, Bellagio, Circus Circus, and MGM Grand. Smart moves, as Nevada continues to be a rickety, fiscally irresponsible state with a rainy day reserves fund of less than 4 days. An asset-light approach is the safe way to navigate Nevada, and will also free up company resources to concentrate on other initiatives. If you’re not the landlord, you can leave the management headaches up to somebody else.

The Nevada real estate crash of 2008 caught MGM by complete surprise, and its moves and plans have signaled that it won’t be caught this time. From 2003 to 2007 MGM was high on the real estate boom, but paid the price. Now on its list of priorities is to divest even further from the real estate market after the MGP spinoff, and execute what it calls an “asset-light” strategy. It’s looking specifically to dilute its interest in properties at MGM Springfield, Bellagio, Circus Circus, and MGM Grand. Smart moves, as Nevada continues to be a rickety, fiscally irresponsible state with a rainy day reserves fund of less than 4 days. An asset-light approach is the safe way to navigate Nevada, and will also free up company resources to concentrate on other initiatives. If you’re not the landlord, you can leave the management headaches up to somebody else.

The good news is that operating expenses are likely to fall next quarter and revenue to rise. First, MGM Springfield finally opened up at the end of August. Diversifying away from Las Vegas is a good sign, but then again Massachusetts is in even worse fiscal shape than Nevada, getting an F from TruthinAccounting last June. Park MGM is just about done with its transformation, which should also bring down expenses and bring up revenues out of that venue. Construction annoys gamers as it does everyone else. MGM Cotai has Golden Week coming up in Macau and will have its VIP operations ready for the event. All of this is exciting news, but it also raises expectations, not a good thing for stock prices.

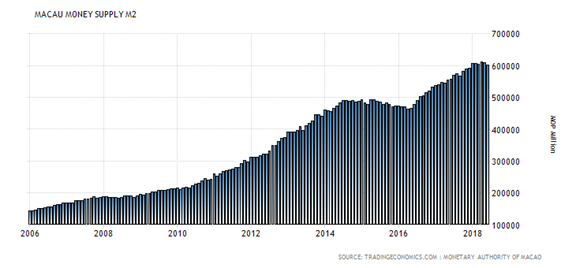

As for headwinds, Last quarter, MGM China EBTIDA came in $40M below expectations, so further disappointing numbers out of MGM Cotai after all the delays could negatively affect shares. MGM still doesn’t have the Macau reputation of its competitors, plus China continues to be unstable. Emerging markets, of which China is considered one, are dropping like flies, the Yuan is under pressure and just bounced off multiyear lows 3 weeks ago, and money supply in Macau is down 1% on the year. The last time that the Macau money supply was down for such a long period of time was in mid 2014. It looks like it may be turning down again, and this on the back of $200B more in US tariffs set to take effect on September 6th in just two days. Trump is unlikely to back down.

Here is the chart to watch. Notice flat Macau money supply for most of 2008 and an obvious drop around 2014. It looks like a monetary decline may be starting again. Two or three more months of data should confirm.

Don’t be surprised by mediocre results out of Macau for MGM next earnings, which could hurt investors considering the excitement that MGM is trying to drum up over Cotai.

Back to Las Vegas, the MGM Economic Indicator, using visitor volumes at its Las Vegas resorts to gauge the health of the broader economy, remains greenish as of last earnings but could turn down for the current quarter. Reports of a slowdown in casino gaming revenue in Nevada for July by the Nevada Gaming Control Board suggest caution, though up through the end of June at least, volumes have kept on chugging higher.

Slot handle was up 1.5% in Las Vegas, and table games drop was up 4.5% year over year for the last quarter ended June 30th. The latest quarterly earnings do not take into account the reported slowdown in July, so we could see a downside surprise next earnings. Declines for July were focused on the Las Vegas Strip itself, with gaming revenue down 5.7%. We may have reached the turning point at the end of June, though we’ll have to see by next earnings.

There are other hints that we may be headed down from here. MGM guidance for 2018 is for single digit decreases in net revenues, RevPAR down in the single digits which means either lower prices or less visitors, but probably weighted towards less visitors because prices are rising all over the US now.

MGM’s outlook for 2020 looks off to me. They are planning about $2 billion in buybacks from now until 2020 and touting their own stock as a “tremendous opportunity for us” which sounds too try-hard. Stock buybacks are not a tremendous opportunity. Buybacks are just dividends by another name, a side effect of loose money, and money is about to get tighter as inflation goes higher. Projecting out to 2020 on share buybacks also raises expectations and pins current stock value to that projection. If things get rough they may need that money for other purposes.

The conclusion, while MGM overall looks to be in pretty good shape as a whole, no serious debt issues, exciting near-future prospects, a smart and patient real estate divestment plan and ambitions for Japan, I wouldn’t bet on the stock trending higher from here, at least not in the near term. Expectations are too high in the face of instability and we don’t know how many investors are holding now expecting to sell on those expectations being realized. If they aren’t realized, we could end up with a lot of MGM holders underwater looking for a way out.