Nevada casinos have to ensure that gamblers who partake of the state’s legal marijuana products don’t go reefer mad at the gaming tables.

Nevada casinos have to ensure that gamblers who partake of the state’s legal marijuana products don’t go reefer mad at the gaming tables.

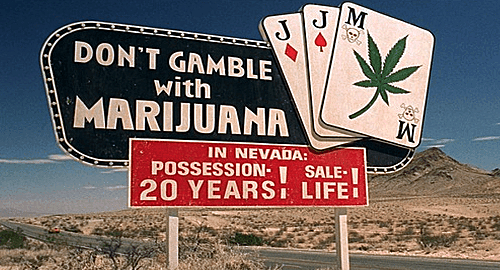

Last week, the Nevada Gaming Commission (NGC) amended its rules governing gambling while under the influence of intoxicants to incorporate Nevada’s newly legal recreational marijuana use. Nevada began legally selling the herb to adults over the age of 21 on June 30, 2017 and the rest of the state’s legal environment continues to play catch-up.

Nevada’s gaming laws already prohibit casinos from dealing with gamblers who are alcohol-impaired, but the new policy declares that gamblers who are “visibly intoxicated” from marijuana can neither gamble nor be sold alcohol inside a casino.

The precise definition of ‘visible intoxication’ from pot use remains a bit of a mystery, suggesting anyone who suffers from an involuntary bout of the giggles or appears a little too interested in finishing that bag of Cheetos could find their evening’s entertainment on the gaming floor brought to an abrupt and unceremonious end.

NGC chairman Tony Alamo told local Fox affiliate KVVU saying that “it’s not smart to allow impaired people to gamble,” regardless of what caused that impairment. According to Alamo, the change simply reflects the changing times. “Society changes, Las Vegas changes and we change with it.”

While casinos around the world are notorious for allowing behavior by their big-spending VIP customers that would get rank-and-file gamblers tossed out on their ear, the NGC insists that the new pot-happy policy applies across the board. To which we say, sure it does.

Nevada’s pot sales have got off to a blazing start, according to the state Department of Taxation. The state’s 316 licensed pot vendors recorded $35.3m in sales in the month of February, not far off the $35.8m record set last December. The state’s share of February’s bounty came to $6m, bringing the total tax take since last July to nearly $42m, putting the state well on the way to surpassing its $50.3m full-year projection.