The Board of Directors and the owners of LeoVegas AB (publ) (”LeoVegas” or the “Company”) have decided to, as a platform for continued growth, list the Company on Nasdaq First North Premier on March 17, 2016. The intention is to diversify the Company’s ownership base through a combined sale of existing and newly issued shares. Today, the Company publishes the prospectus and the price range in the offering (the “Offering”). LeoVegas is a leading mobile gaming company with a vision create the ultimate gaming experience and be number one in mobile gaming. The shares will trade under the ticker “LEO”.

The Board of Directors and the owners of LeoVegas AB (publ) (”LeoVegas” or the “Company”) have decided to, as a platform for continued growth, list the Company on Nasdaq First North Premier on March 17, 2016. The intention is to diversify the Company’s ownership base through a combined sale of existing and newly issued shares. Today, the Company publishes the prospectus and the price range in the offering (the “Offering”). LeoVegas is a leading mobile gaming company with a vision create the ultimate gaming experience and be number one in mobile gaming. The shares will trade under the ticker “LEO”.

The Offering

- The Offering is made to the general public in Sweden as well as to institutional investors in Sweden and in other countries, including qualified institutional buyers in USA.

- The Offering comprises between 25,985,848 and 26,711,780 shares in LeoVegas, corresponding to 26 – 27 percent of the total number of shares in the Company. Of these shares, between 5,843,750 and 6,678,571 are newly issued shares and between 20,033,209 and 20,142,098 are shares offered by the Selling Shareholders.

- Aggregate Media and certain other Selling Shareholders have reserved the right to, in the event of sufficient demand, increase the Offering with a maximum of 2,462,000 additional existing shares (the “Upsizing shares”), corresponding to maximum 2.5 percent of the total number of shares in the Company after completion of the Offering and based on a subscription price at the top of the price range.

- The Main Shareholders, SEB Foundations2 have provided Carnegie Investment Bank AB (publ) (“Carnegie”) and Skandinaviska Enskilda Banken AB (publ) (“SEB”) (together the “Joint Global Coordinators”) with an overallotment option of up to 4,006,767 additional shares (the “Overallotment Option”), corresponding to maximum 15 percent in the shares in the Offering excluding the Upsizing shares. The Overallotment Option may only be exercised in case of oversubscriptions in the Offering.

- Provided that the Offering is completed at a subscription price corresponding to the midpoint of the price range, and provided that the Selling Shareholders exercise their right to increase the Offering and the Overallotment Option is fully exercised, the Offering will in total comprise of 32,735,309 shares, corresponding to approximately 33 percent of the total number of shares in the Company.

- The offering price will be determined by the board of LeoVegas and the Main Shareholders, in consultation with the Joint Global Coordinators, and will be established in the range of SEK 28 – 32 per share. The final offering price is expected to be published on or around March 17, 2016. The offering price to the general public in Sweden will not exceed SEK 32 per share.

- The total value of the Offering (including the Upsizing shares) based in the price range amounts to approximately SEK 817 – 910 million and approximately SEK 929 – 1,035 million if the Overallotment Option is fully exercised.

| Subscriptionundertaking (MSEK) | Minimumnumber of shares | Percent ofthe Offering (%)3 | |

|---|---|---|---|

| Catella Fondförvaltning AB | 80 | 2,500,000 | 7.7 – 8.6 |

| Handelsbanken Fonder AB | 80 | 2,500,000 | 7.7 – 8.6 |

| Swedbank Robur Fonder AB | 80 | 2,500,000 | 7.7 – 8.6 |

| Carnegie Asset Management | 50 | 1,562,500 | 4.8 – 5.4 |

| Keel Capital | 50 | 1,562,500 | 4.8 – 5.4 |

| Fonden Alcur | 30 | 937,500 | 2.9 – 3.2 |

| AMF Fonder AB | 30 | 937,500 | 2.9 – 3.2 |

| Total | 400 | 12,500,000 | 38.6 – 43.1 |

- Applications for acquisition of shares within the terms of the Offering to the general public in Sweden will commence on March 7, 2016, and is expected to end on March 15, 2016.

- The book-building procedure for institutional investors will commence on March 7, 2016, and is expected to end on March 16, 2016.

- Estimated first day of trading on Nasdaq First North Premier is March 17, 2016, and the shares will be traded under the ticker “LEO”.

- Estimated settlement date in relation to the Offering is March 21, 2016.

Gustaf Hagman and Robin Ramm-Ericson, Co-founders of LeoVegas, comments:

“Not even five years have passed since that spring evening when the concept for the mobile gaming company LeoVegas was born. When other players considered mobile gaming on par with online gaming on a smaller screen, we saw with LeoVegas a completely new world. The breakthrough of the iPhone and other smartphones changed everything and the experience, user enjoyment and playfulness in mobile usage paved the way.

The market for mobile gaming entertainment is still in its infancy. We want LeoVegas to lead the way in terms of product innovation and mobile experience, and we see enormous growth potential in both new and existing markets as well as new product areas. With a clear passion for customer experience, a focused and successful marketing strategy, a proprietary technical platform and an innovations-oriented corporate culture, we feel that LeoVegas is well-positioned for this growth. LeoVegas’ focus on longterm customer relations and a data-driven process have laid the foundation for a scalable business model.

We see a listing of LeoVegas on Nasdaq First North Premier as a natural step of the Company’s development and in particular, we view it as a platform for continued robust growth.”

Introduction to the mobile gaming company LeoVegas

LeoVegas is a fast-growing mobile gaming company that aims to be the market leader in mobile casino and related gaming entertainment. The Company was founded in 2011 by entrepreneurs Gustaf Hagman and Robin Ramm-Ericsson with the objective of creating the ultimate gaming experience on mobile devices. The operations are characterized by award-winning innovation and strong growth. LeoVegas offers opportunities to play casino games and engage in other forms of online gaming using applications and browsers on primarily mobile devices (such as smartphones, tablets and smartwatches). LeoVegas currently offers more than 680 online games from more than 30 game providers. The Company also plans to introduce sports betting, which is scheduled to be launched during the first half of 2016.

LeoVegas is developed “Mobile First” and is in pole position in terms of the latest technology on the mobile gaming market. With an outstanding gaming experience, long-term customer relationships and the establishment of a strong brand as starting point, the Company, through innovative, effective and data-driven marketing, has attracted a continuously growing customer base. Parent company LeoVegas AB (publ) invests in companies that offers games via mobile devices and computers, as well as companies that develop related technology. The headquarters is located in Stockholm, operational activities are run through subsidiaries, the gaming business is based on Malta, and its technological development are based in Sweden. LeoVegas offers casino games under licenses from Malta and the UK.

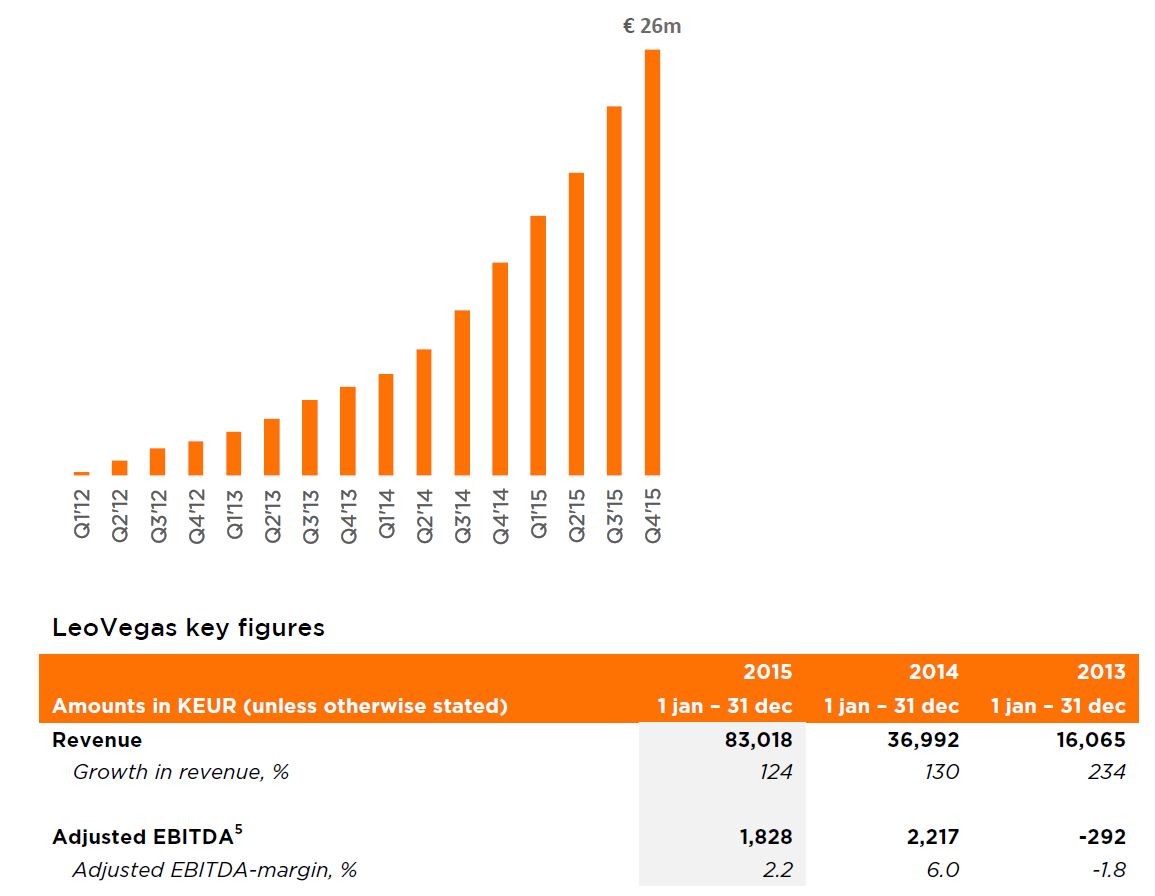

Since LeoVegas was launched in Sweden in January 2012, the Company has grown strongly and expanded considerably internationally with total customer deposits4 exceeding MEUR 450. The most important markets for the Company is currently the Nordics and the UK. For the fiscal year 2015, the Company’s net sales amounted to MEUR 83, a growth of MEUR 46, corresponding to an organic growth 2015 of 124 percent. The mobile gaming company LeoVegas has since its foundation shown strong growth every quarter.

Revenue per quarter (MEUR)

A deposit is defined as a customer’s depositing of funds into a gaming account at LeoVegas.

Adjusted EBITDA refers to adjusted costs in relation to the Company’s preparation of the IPO on Nasdaq First North Premier

LeoVegas financial targets

LeoVegas has set financial targets in relation to the Company strategy as follows:

Growth:

- LeoVegas’ target is to reach EUR 300 million in net sales in 2018.

- Long-term organic growth that outperforms the online gaming market.

Profitability:

- LeoVegas’ target is to reach an EBITDA margin of approximately 15 percent in 2018.

- Long-term EBITDA margin of no less than 15 percent assuming that 100 percent of the revenue is generated on regulated markets subject to gambling tax.

Dividends:

- LeoVegas’ dividend policy, over time, is to pay dividends of at least 50 percent of LeoVegas’ profit after tax.

Application Instructions for acquisition of shares

Applications for acquisition of shares within the terms of the Offering to the general public are to be made during the period 7 – 15 March 2016. Applications shall be made in even lots of 100 shares, a minimum of 200 shares and a maximum of 20,000 shares6. Applications must be made by using a certain application form from which can be obtained at any SEB office, or can be ordered from the Company. Applications can also be made through SEB’s Internet bank or Avanza’s (www.avanza.se) or Nordnet’s Internet service (www.nordnet.se/kampanjer/ipo/leo-vegas.html).

For more information, please contact:

Gustaf Hagman, Group CEO and Co-founder: +46 70-880 55 22, [email protected]

Viktor Fritzén, Group CFO: +46 73-612 26 67, [email protected]

www.leovegasgroup.com

Those who wish to subscribe for more than 20,000 shares are regarded as institutional investors and should contact

Carnegie or SEB Equities in accordance with what is stated in the section “The Institutional offering” in the prospectus.

Important information

This announcement is not and does not form a part of any offer for sale of securities. Copies of this announcement are not being made and may not be distributed or sent into the United States, Australia, Canada, Japan or any other jurisdiction in which such distribution would be unlawful or would require registration or other measures.

The securities referred to in this announcement have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), and accordingly may not be offered or sold in the United States absent registration or an exemption from the registration requirements of the Securities Act and in accordance with applicable U.S. state securities laws. The Company does not intend to register any offering in the United States or to conduct a public offering of securities in the United States.

The offering of the securities referred to in this announcement will be made by means of a prospectus.This announcement is not a prospectus for the purposes of Directive 2003/71/EC (together with any applicable implementing measures in any Member State, the “Prospectus Directive”). Investors should not invest in any securities referred to in this announcement except on the basis of information contained in the aforementioned prospectus.

In any EEA Member State other than Sweden that has implemented the Prospectus Directive, this communication is only addressed to and is only directed at qualified investors in that Member State within the meaning of the Prospectus Directive, i.e., only to investors who can receive the offer without an approved prospectus in such EEA Member State.

This communication is only being distributed to and is only directed at persons in the United Kingdom that are (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”) or (ii) high net worth entities, and other persons to whom this announcement may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). This communication must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this communication relates is available only to relevant