This is a guest contribution by Lisa Wisniowski of Stickyeyes. If you would like to submit a contribution please contact Bill Beatty for submission details. Thank you.

- Nearly 50% of online customers now gamble on mobile devices with sportsbook accounting for 47% of the mobile market

- Paddy Power is reaping the benefits of early adoption of mobile app marketing with 18.9% of the overall organic mobile click share

- Blanket ban on real-money applications in Google Play brings challenges but commercial potential is huge

- Small number of high value keywords, including ‘mobile casino’ are driving the greatest volume of traffic

Early adopters of mobile application marketing, Paddy Power, William Hill and Betfair are leading the growth of mobile app gaming, according to Stickyeyes latest gambling intelligence report on the mobile app market.

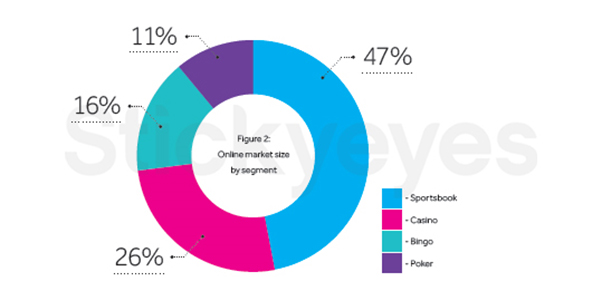

These brands are reaping the commercial benefits of investment in highly usable apps to support half of all online gamblers who state mobile apps are their preferred way to bet or play. Sportsbook is leading this growth in mobile gaming (see supporting figure – online market size by segment), accounting for 47% of the mobile market whilst casino follows with just over a quarter (26%) then bingo (16%) and poker (11%).

The growth of mobile comes despite restrictions on Google Play, which prevents the listing of real-money apps, and forces gaming brands to employ dedicated search marketing campaigns to aid app discovery and adoption. As a result, the mobile keyword landscape is becoming increasingly competitive, with an average of 111,607 searches per month for betting, poker, casino and bingo keywords on mobile devices.

The most searched for phrase is bingo, with 18,561 searches per month on mobile devices representing 30% of all bingo search volume. Sky Bingo, Gala Bingo and Ladbrokes are the winners here holding 30.93% of the overall mobile bingo click share.

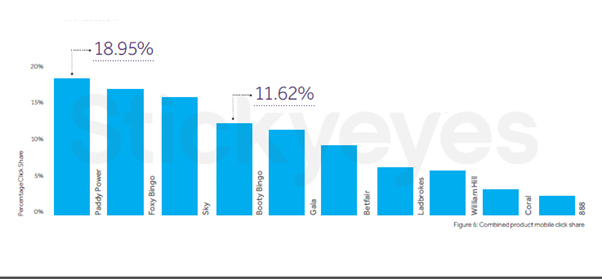

Paddy Power dominates the three other verticals, taking 18.95% of the total overall mobile click share in the gambling sector (see supporting figure – combined product mobile click share). The brand holds 24.69% of the casino click share, 35.94% of the sportsbook click share and is one of the top three brands in the mobile poker sector.

Said Phil Kissane, Managing Director at Stickyeyes: “With mobile gaming growing from 29% to 43% over the course of 2014 and tablet and smartphone adoption rates increasing year-on-year, it is clear that mobile applications should now be a fundamental part of any successful gaming brands business strategy. Brands who invest in optimising their mobile assets and applications, as well as strengthening their brand presence across mobile platforms will be rewarded with a highly loyal, engaged and active audience”.

Key learnings for gambling brands:

- You’ll need to work hard with Android, but the potential is hugeWhilst the route to app discovery is relatively simple for iOS users, the process is much more complicated for the Android platform. This process is highly dependent on organic search visibility, requiring brands to optimise their mobile search campaigns, and their mobile landing pages, to drive app downloads and engagement.But, the rewards are most definitely worth the effort, with Android users representing a significant, and largely underserved, proportion of the market – 66.8% of the current European smartphone market. Those brands that have been quick to embrace this approach, including early adopters William Hill and Paddy Power, are now reaping the rewards from their investment in organic mobile app campaigns.

See supporting figures for more detail.

- A small number of high value keywords are driving revenueMobile search is a very different market to desktop search, with a significantly smaller long-tail market. Because of the difficulties in text entry on small screen devices, mobile searches are dominated by a small cluster of keywords and Google Suggestions. This creates an extremely competitive keyword market.Mobile specific keywords, such as “mobile casino” have much lower search volumes and are less competitive, but incredibly conversion-friendly. These search terms indicate a user that has made the decision to play on mobile, so work to get your brand in prime positions.

- Don’t dwell on vanity metricsWhilst lots of brands focus on download statistics, these tell just a fraction of the overall picture when it comes to a mobile app strategy. Around one fifth (22%) of mobile apps are abandoned after download, so your download report is likely to be reporting on a significant number of non-revenue driving users.Download numbers have their value, and are a key signal for many app store algorithms, but instead focus on more meaningful metrics, such as ongoing engagement and user revenue.

- App store optimisation relies on modern SEO principlesOptimising for app stores is a major challenge for brands, but the fundamental principles of SEO still apply. The metrics may be different but, the method remains the same; create quality applications that meet the needs of your target audiences.In researching this report we have seen many examples of brands using dated SEO techniques, particularly keyword stuffing, as part of their mobile strategy. Instead, focus on useful apps and engaging copy to drive downloads, create positive reviews and, ultimately, increase your prominence in the app stores.

Request your free copy of the report at here.

For further information, please contact:

Lisa Wisniowski, Stickyeyes

T: 0113 391 292 E: [email protected]

@lisawisniowski /@stickyeyes

Supporting graphs

Figure – Online market size by segment

Figure – Combined product mobile click share

Figure – User journey to app discovery on IOS

User journeys describe paths that a customer may take in order to convert. User journey is commonly overlooked with marketing deployment and in the context of app deployment many brands fail to recognise its place in defining and optimising activity. On IOS devices, the typical user journey to app discovery is via two primary actions – app store search and app store category search.

Figure – user journey to app discovery on Android

Compared to IOS, the journey to discovery on Android devices typically involves more steps and traverses a range of digital media channels and brand assets.