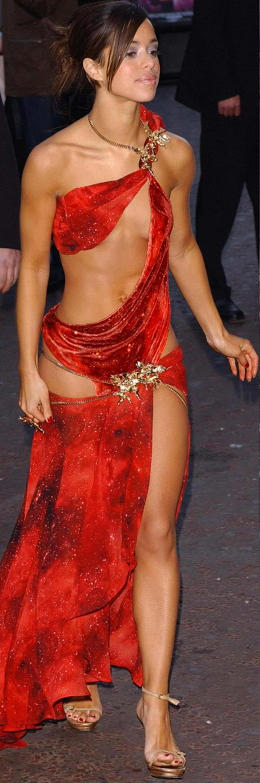

So it’s that time of year again, when a fresh crop of trading updates and quarterly reports start flying fast and furious. As ever, CalvinAyre.com will dutifully report these reports, albeit in our traditional prurient fashion. Today, it’s three UK-based companies, so we’ve selected one of our favorite slices of UK crumpet, Tina Barrett, to accompany these reports. Barrett is a former member of the execrable S Club 7, an inexplicably successful attempt to marry the Spice Girls with the Backstreet Boys. Regardless of her past sins, she remains a serious challenge to any atheistic beliefs, because only a divine being could have created something so heavenly. But we digress…

So it’s that time of year again, when a fresh crop of trading updates and quarterly reports start flying fast and furious. As ever, CalvinAyre.com will dutifully report these reports, albeit in our traditional prurient fashion. Today, it’s three UK-based companies, so we’ve selected one of our favorite slices of UK crumpet, Tina Barrett, to accompany these reports. Barrett is a former member of the execrable S Club 7, an inexplicably successful attempt to marry the Spice Girls with the Backstreet Boys. Regardless of her past sins, she remains a serious challenge to any atheistic beliefs, because only a divine being could have created something so heavenly. But we digress…

RANK GROUP

Gambling operator Rank Group turned in a Q1 trading update showing strong growth at its online gambling operations. The group, which operates the Grosvenor Casinos, Mecca and Spanish-facing Enracha bingo brands, reported a modest 2% gain in group revenue in the 15 weeks to Oct. 12 over the same period last year.

The Grosvenor Casinos brand saw revenue improve 5% year-on-year, with venues revenue up 3%, customer visits up 2% and spend per visit gained 1%. However, the Grosvenor digital offering reported a hefty 71% revenue gain, which the company credited to improvements in VIP management, increased cross-sell from retail venues and last November’s launch of its live dealer casino offering.

Digital was also the star at Mecca bingo, where revenue was flat but would have been much worse if not for online gains. Mecca venues revenue fell 1% as customer visits fell 3%, which offset a 2% rise in spend per visit. Mecca’s online operation gained 4% thanks to recent TV marketing and “a more competitive sign-up bonus.”

Rank also announced a management shakeup, with Phil Urban leaving the company after six years as Grosvenor managing director. Mecca’s current managing director Mark Jones will take over Urban’s role while Rank CEO Henry Birch will act as interim managing director of Mecca operations.

SKY BETTING AND GAMING

Alderney-licensed Sky Betting and Gaming saw its Q1 2015 revenue jump 60% thanks mainly to the 2014 FIFA World Cup, the tide that lifts all betting boats (even Bwin.party’s leaky vessel). The gambling subsidiary of the BSkyB broadcasting behemoth generated £56m in the three months ending Sept. 30 and the company expects the good times to keep rolling thanks to the horde of new customer acquisitions during the quadrennial football festival.

Sky Bet managing director Richard Flint told eGaming Review that the company had managed to retain many of those new customers long after the final goal was scored in Brazil thanks to its Sky Bet Club promotion. The company has high hopes of converting its new sports bettors to Sky Bet’s new Playtech-powered SkyCasino brand, which includes a live-dealer option to target table game players. Flint says the addition complements its existing SkyVegas casino brand by offering “different propositions to different sections of the customer base.”

Sky Bet managing director Richard Flint told eGaming Review that the company had managed to retain many of those new customers long after the final goal was scored in Brazil thanks to its Sky Bet Club promotion. The company has high hopes of converting its new sports bettors to Sky Bet’s new Playtech-powered SkyCasino brand, which includes a live-dealer option to target table game players. Flint says the addition complements its existing SkyVegas casino brand by offering “different propositions to different sections of the customer base.”

Flint also shed light on the company’s international ambitions. Sky Bet has hired consultant Graham Ross to help guide the company’s expansion beyond the UK, which will likely start by entering the Italian regulated market but could also include Germany at some future date. BSkyB firmed up its own Italian and German presence over the summer, which may help smooth the betting arm’s regulatory introduction into these markets. Flint also suggested a Sky Bet social gaming product could make its debut sometime this winter.

NETPLAY TV

Finally, NetPlay TV may have been one of the few gaming operators celebrating the end of the World Cup. The online gambling operator had attributed the 50% decline in its H1 2014 profits to its customers being distracted by those damn players chasing that stupid ball all over Brazil, so good riddance to that for another four years.

NetPlay TV Plc’s Q3 trading update showed revenue was essentially flat at £6.4m, down around £100k from the same period last year. NetPlay says it enjoyed a 21% gain in new depositing players and a 22% rise in active depositing players. Despite these gains, NetPlay’s interim CEO Bjarke Larsen said the company “has not achieved the targeted levels of new customers and net revenue.” Larsen warned that full-year results would wind up “materially lower than forecast.”

Larsen said NetPlay had to get smarter at how it allocated its marketing budget, which he blamed for most of the expected full-year shortfall. Larsen believes the industry as a whole has been overspending on marketing in a frantic bid to acquire customers before the UK’s dreaded 15% point-of-consumption tax kicks in on Dec. 1, after which time profits will become harder to find than traces of cellulite on the backs of Ms. Barrett’s stellar stems.