Nevada’s top gambling regulator has expressed grave reservations over the state’s proposed ‘entity betting’ legislation. Nevada Gaming Control Board (GCB) chairman A.G. Burnett says the SB 346 legislation – which would allow private equity firms to place sports wagers on behalf of their clients with Nevada sports books – could result in damage to the state’s reputation as the country’s premier gaming regulatory jurisdiction if the entities engage in any shenanigans.

Nevada’s top gambling regulator has expressed grave reservations over the state’s proposed ‘entity betting’ legislation. Nevada Gaming Control Board (GCB) chairman A.G. Burnett says the SB 346 legislation – which would allow private equity firms to place sports wagers on behalf of their clients with Nevada sports books – could result in damage to the state’s reputation as the country’s premier gaming regulatory jurisdiction if the entities engage in any shenanigans.

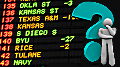

The Nevada senate unanimously approved SB 346 last month based on its backers’ contention that allowing hedge funds and other investment managers to place large wagers on behalf of deep-pocketed clients could possibly triple the state’s sportsbook handle. But when Burnett spoke with CalvinAyre.com’s Becky Liggero at the recent GIGSE conference in San Francisco, he said “you can have a lot of handle, it can run into the billions of dollars. The true question is what is the benefit to the state, to the regulatory agencies, to the operators that house sports betting.”

On Friday, the Associated Press quoted Burnett telling the state Assembly Judiciary Committee that the GCB wasn’t sure how SB 346 “complies with federal law.” The 1961 federal Wire Act makes it illegal to communicate across state lines for the purpose of placing sports wagers. While SB 346 would require entities to establish a base of operations in Nevada and identify “all members, partners, shareholders, investors and customers,” the bill appears to envision a system in which a bettor/investor in, say, New York, could call in a wager to his local broker, who would then relay both the wagering specifics and the money itself to the firm’s Nevada branch office/shell company/guy-at-the-back-of-the-bar. Any winnings would be similarly transferred back out of state to the original client.

While much will depend on the specifics of the regulations the GCB would need to write to make SB 346 a reality, Burnett believes the above scenario would “gut” the Nevada state law barring ‘messenger’ betting, which prevents bettors from paying another individual to place a wager on their behalf. Changing a state law is well within Nevada’s abilities, but Burnett says he would want either a written opinion by the US Department of Justice and/or new federal legislation stipulating that such interstate activity wouldn’t contravene the Wire Act.

Reflecting Burnett’s concerns, the GCB has attached a potential ‘poison pill’ to SB 346. The GCB says it would require $745k in additional funding over the next two years to enforce the legislation, while the entities themselves will be forced to cover the costs of determining their suitability to engage in sports wagering on a mass scale.

The prospect of companies like Goldman Sachs getting into the sports betting business will likely raise more than a few eyebrows. You have to wonder, would Goldman create new ‘financial instruments’ that enable customers to bet against other Goldman customers’ sports wagers, much as Goldman infamously bet against the dodgy derivatives it peddled to its own clients? And if a ‘too big to fail’ financial firm like Goldman loses a bunch of its wagers, would it look to the federal government for another bailout?