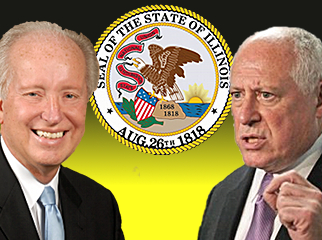

Just 48 hours after Illinois Gov. Pat Quinn (pictured far right) vetoed a bill that would have put brick-and-mortar casinos in Chicago, state Senator Terry Link (pictured on the left) has introduced an amended bill that would expand the state’s land-based gambling options and also introduce internet gambling. Illinois’ previous attempt at passing online gambling legislation – which envisioned the state lottery running the system and the state’s existing gaming license holders serving as affiliates – died from neglect last June.

Just 48 hours after Illinois Gov. Pat Quinn (pictured far right) vetoed a bill that would have put brick-and-mortar casinos in Chicago, state Senator Terry Link (pictured on the left) has introduced an amended bill that would expand the state’s land-based gambling options and also introduce internet gambling. Illinois’ previous attempt at passing online gambling legislation – which envisioned the state lottery running the system and the state’s existing gaming license holders serving as affiliates – died from neglect last June.

Among Link’s proposed amendments to SB 1739 (full text here, with the internet section starting on page 78) is the establishment of a Division of Internet Gaming to oversee online gambling in the state. While the types of games to be permitted online aren’t specified by name, the legislation would allow games based on “skill or chance.” The only explicit prohibition is put on sports betting, and even that would be allowed if federal laws change.

Online gambling licenses – both for operators and technology vendors – would be valid for five years and applications must be accompanied by a non-refundable $250k. Those operators lucky enough to be awarded licenses will have to put up $20m as an advance payment on wagering taxes, which are 20% of gross gaming revenue for “non-fee-based games” and 15% for “fee-based games” aka poker. However, for the initial five-year period, non-fee-based games will be taxed at 10% on the first $200m of GGR and 20% on anything above $200m. Similarly, fee-based games will be taxed 7.5% on the first $200m of GGR and 15% above that sum for the initial five-year period. An annual $10m of the state’s tax haul will be devoted to problem gambling programs. All server technology must be located within state lines.

License eligibility would be restricted to holders of state-issued gaming licenses, including casinos, electronic gaming facilities and advance deposit wagering racetracks. As for their technology partners, Illinois’ definition of a ‘bad actor’ exceeds that of even Nevada, as license applications would not be accepted from any entity that “has accepted wagers via the Internet in contravention of this Section or United States law in the 10 years preceding the application date.”

The legislation is focused initially on an intrastate model, but allows for “agreements with other gaming entities, including foreign entities,” provided no state or federal laws are broken. Illinois has a population of nearly 13m, larger than any other state that has so far passed online gambling legislation, making it the new belle of the ball as far as interstate compacts are concerned.

Quinn’s veto earlier this week of the land-based bill was based on his concerns over the lack of restrictions on political campaign contributions by gaming licensees and casino executives. Link’s amendments include such prohibitions on funny money, thereby removing Quinn’s principal objection. (Although we object to Link’s statement that “gaming is especially susceptible to corruption and potential criminal influence.” Really, coming from a Chicago pol, that’s a bit rich.)

So will the Illinois pols’ quick response to address Quinn’s concerns result in the change of heart we saw from New Jersey Gov. Chris Christie, who slapped a conditional veto on his state’s online gambling legislation, only to sign an amended version into law 10 days later? Or will the inclusion of online gambling simply give Quinn fresh reason to ink up his veto pen? Watch this space…